While the upcoming USDA report will certainly be one to watch, there are other factors you need to pay attention to as you formulate your grain marketing plans.

What’s happened

Corn and soybean prices have settled back lower after the late July price rally. Weather in the United States is mostly benign, and for the moment, traders are assuming that the crop, while likely not a record, will be “good enough.”

Because of this mindset, November soybean futures had a price peak near $14.30 just a couple weeks ago, with prices now trading near $13 as of this writing.

December corn futures traded as high as $5.70 just a few weeks ago, with prices trying desperately to cling to the $5 price support area as of this writing.

Without any fresh fundamental news to trade on, traders may be looking to other market influences that could affect grain prices.

From marketing perspective

Often times in the grain marketing world, it is important to monitor “outside market” events, and not just traditional fundamentals such as yield or USDA reports. That includes geo-politics, global economics, energy prices, and fund money activity. Currently there are three outside market factors that hold my attention, and they need to have your attention, too.

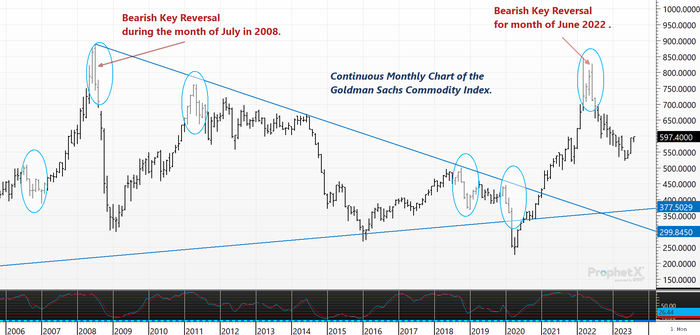

Goldman Sachs Commodity Index

If the sound of this is ringing a bell, I have written about this factor before. The GSCI index is important because it measures the value of 24 different commodities, all into one index number. The metric is a mix of precious metals, energies, grains, livestock, and softs (i.e., cotton, sugar, coffee, and cocoa).

In fact, just over one year ago, I alerted you to the fact that the Goldman Sachs Commodity Index (GSCI) had posted a technical topping signal with a bearish key reversal. When this technical indicator occurs, it is often a sign that a rally has ended. When a bearish key reversal occurs on the GSCI, history has suggested that commodity prices have likely topped out, and many commodity prices could potentially start the price slide lower.

With hindsight, that was indeed the case for many grain and oilseed commodities, and energy markets.

What I’m noticing on the monthly GSCI chart now, is that after one year of lower prices, the index seems to be mustering up and consolidating at a level of price support.

While there is not an official sign of a “bottoming action,” it does appear that at least the downward price pressure has paused for the moment.

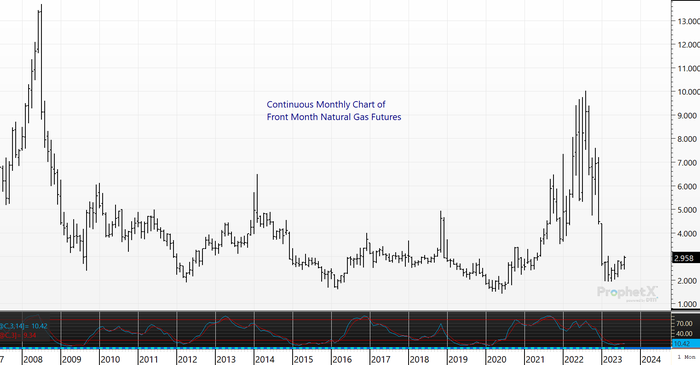

Energy prices: Natural gas and crude oil

After trading in a sideways pattern since November 2022, crude oil futures are poking through overhead technical resistance on continuous weekly charts.

Looking at the chart, one could also argue that a “rounded bottom” formation has occurred, with prices poised to technically work up to the $96 level, if friendly fundamental news can justify the price move.

From a fundamental standpoint, OPEC is doing its best to continue to cut oil production. Also supportive is the ongoing war in Ukraine and Russia. In addition, traders see a high likelihood that the Federal Reserve is nearly done raising interest rates, which means commodity demand may improve, with a positive outcome for oil consumption.

Natural gas futures are also starting to break out higher in response to a threatened strike at an Australian liquid natural gas company. Australia is the world's second-biggest liquid natural gas exporter (behind Qatar) and any reduction in exports would tighten global natural gas supplies.

It is said that hundreds of millions of dollars in exports are at stake.

Remember the natural gas price rally we saw in 2022? That was in response to the war and threats that natural gas flows to Europe would be cut off by Russia. Prices are still far lower than their all-time highs from just under a year ago after Moscow first dropped export flows.

The funds

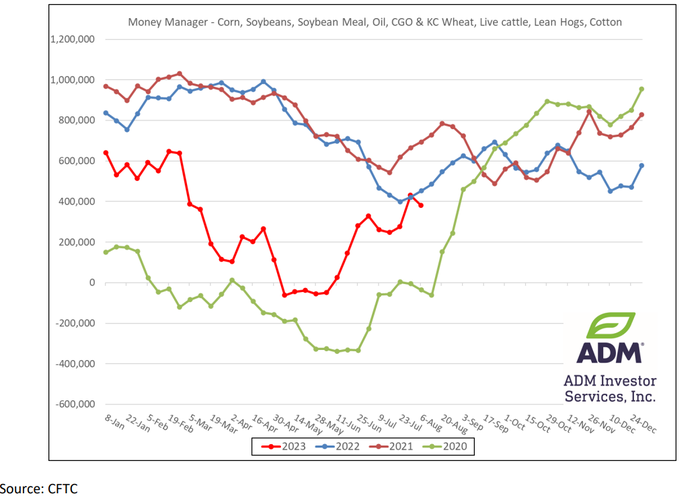

The big managed money in the marketplace had been primarily absent in the agricultural commodity space over the past year (compared to the previous two years).

It’s not that the funds were not there; they just were not participating in trading like they had in years past.

When interest rates started to rise one year ago, the funds exited many long grain and oilseed positions. The thought was that higher interest rates would curb demand appetite for commodities.

Remember also, that when interest rates go up, the funds can make “easier” money with a return on investments in other areas, potentially using financial instruments such as CDs, currently netting a return rate of nearly 5%.

Why deal with the daily drama of commodity trading when you can make a 5% return on a financial investment by parking money in a CD instead?

Look at the chart below compiled by my friends at ADMIS.

Focus your attention on the red line. This red line represents the combined long position of funds in the agricultural space for 2023. You can see how for the first seven months of the year, the funds were not active participants like they had been in 2021 and 2022.

But you can also see that something might be getting ready to occur in the coming weeks.

Looking at years past, starting in early September it seems that the funds either amass a new longer position in the agricultural space, or at least, hold steady with the long position, and at least, don’t “sell it off.”

Prepare yourself

While there is a USDA WASDE report being released soon, a bearish report is already priced in and expected, and it’s unlikely the USDA will pull out any unexpected bullish surprises. Therefore, trade is going to very quickly search for a different story to trade. And that story will likely be these outside market influences.

A year ago, when the Goldman Sachs Commodity Index peaked, and interest rates began to march higher, commodity prices edged lower. With hindsight, it was one of those times when commodity prices bowed to the pressure of negative outside market influence.

Now, that story might be starting to change. Energy prices are starting to increase, the Goldmans Sachs Commodity Index may be trying to form a price bottoming support area. And the funds are actually slowly growing a long position in the overall agricultural commodity space. Seasonally, grain futures tend to find a seasonal price low in late August, and might that coincide with these outside markets factors -- which might be turning friendly?

Reach Naomi Blohm at 800-334-9779, on Twitter (@naomiblohm) and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

About the Author(s)

You May Also Like