Hooray for a price rally in the first half of May! While Dec’24 corn prices are getting close to the year-to-date high of $4.98¾ set on January 4. Soybean and wheat prices are also strong.

In last month’s column I drew a bead on price tendencies in the December new crop contract for corn. My analysis revealed few secrets, but it was interesting to review the numbers. This month I turn my attention to price tendencies in the November new crop contract for soybeans.

To examine November soybean futures prices, I will address the same questions as last month when I looked at December corn.

In what months have the highest price for November soybeans futures been established?

In what months have the lowest price been established?

In what month has November soybeans futures prices shown the greatest volatility?

In what months have the highest price for November soybeans futures been established? Since 1990, November soybeans futures reached its highest closing price in the months of May and June (see chart). Contract delivery year high prices never occurred in the Jan/Feb period. This remains true in 2024 because on May 7, Nov’24 soybean prices topped the previous YTD high price of $12.25¼ set on January 3. Like December corn, Jul/Aug recorded the second most high prices since 1990.

Data source: CBOT closing prices for November soybeans. Note that the months of December and November were noted separately. I did this so the remaining two-month segments would be consistent with last month’s analysis on December corn.

In what months have the lowest price been established? The lows are fairly evenly split throughout the calendar year. The months of July and August are interesting, when the market was almost equally apt to set a high price or a low price for the calendar year. “July makes the corn crop,” but “August makes the bean crop,” and the nearly equal chance of a high or a low in the Jul/Aug period speaks to the make or break importance of these two months.

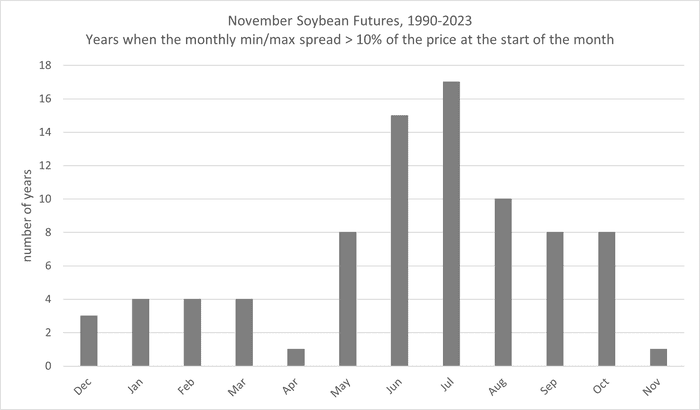

In what month has November soybeans prices shown the greatest volatility? The last chart shows the numbers of years when the monthly min/max price spread was greater than 10% of the price at the start of the month. Let me rephrase that. If November soybeans were trading at $10/bu. at the start of a month, this chart records years when the difference between the highest and lowest price in the month would have been greater than $1.00/bu. (if $15 soybeans, the min/max spread was greater than $1.50/bu., etc.).

During the month of July in 17 of the last 34 years (50%), the min/max price spread was greater than 10%. With Nov’24 soybean futures currently trading near $12.00/bu., this chart indicates a 50% chance of a July trading range of $1.20 or more per bushel. Like December corn, November soybean futures show the greatest price volatility during the growing season months of June, July, and August.

Data source: CBOT closing prices for November soybeans. “Dec” refers to the month one year prior to the delivery month.

The current strength in corn and soybean prices are a mystery. With few exceptions, the U.S. crop is being planted in a timely fashion. Rain? We've had ample rains with minimal signs of drought remaining in the Corn Belt. Prices should be on the defensive but they are strong. I think every producer should treat the current price strength as an opportunity to price and move last year’s crop. If you lack storage and anticipate the need to move grain at harvest, this is also a chance to price some new crop for harvest delivery.

About the Author(s)

You May Also Like