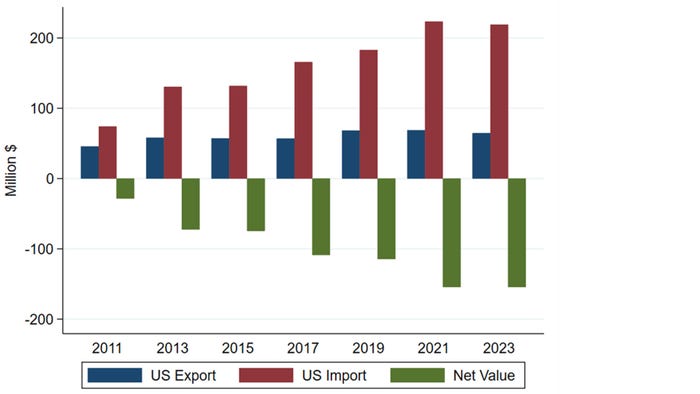

Increased attention among consumers to the healthfulness and environmental footprint of their diet has expanded opportunities for organic products both in the U.S. and abroad. These developments have major implications for international trade. In just a little over a decade, the total value of imported organic products has nearly tripled from $667 million in 2011 to about $2 billion in 2023 (Figure 1). Over this same time period, U.S. exports have increased from $412 million to $582 million.

Figure 1. The US Organic Trade from 2011 to 2023

Most highly traded products

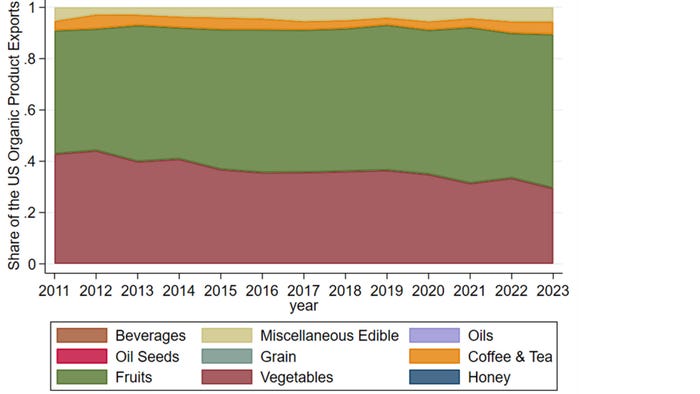

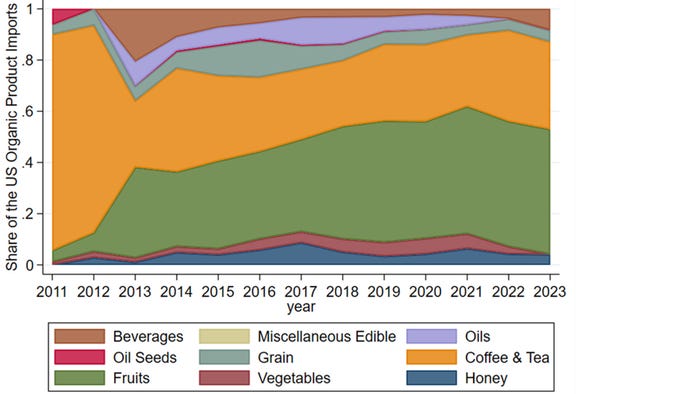

On the export side (Figure 2.a), the majority of organic trade is in fruits and vegetables. These products accounted for about 60% and 30% of exports in 2023, respectively. Things have evolved differently on the import side (Figure 2.b). In 2011, U.S. organic imports were dominated by coffee and tea. These products accounted for about 84% of imports at that time. Today, coffee and tea represent only 34% of U.S. organic imports. This is not to say that these imports have disappeared. In fact, the value of coffee and tea imports has increased from $563 to $673 million over the time period. So, the decline in the import share of coffee and tea is actually due to the rapid expansion in the import of other organic products — namely fruit, which accounted for about 50% of organic imports in 2023.

Figure 2. Product Composition of U.S. Organic Trade

U.S. organic trade partners

Canada is the largest market for U.S. organic products (annually importing $7 million), followed by Mexico ($4 million), Japan ($0.9 million), Taiwan ($0.7 million), and South Korea ($0.4 million). In terms of organic imports, Mexico is our largest trade partner (sending $11 million worth of organic products to the U.S. per year). Peru, Colombia, and Honduras are the second, third, and fourth largest players, annually sending about $9 million, $7 million, and $7 million worth of organic products to the U.S. per year, respectively.

(b) U.S. Organic Imports

One major driver of organic trade is the negotiation and implementation of Organic Equivalency Agreements (OEAs) with many of our trade partners. These OEAs are essentially “two-for-the-price-of-one” agreements from the perspective of organic producers. OEAs allow producers who are certified to produce organic products in their home country to label their products as organic in the U.S. (or vice versa) without going through the extra hassle and cost of the additional certification process. As of March 2024, the U.S. has OEAs with Canada, European Union, Japan, South Korea, Switzerland, Taiwan, United Kingdom, New Zealand, and Israel.

Source: Southern Ag Today, a collaboration of economists from 13 Southern universities.

Read more about:

OrganicAbout the Author(s)

You May Also Like