Markets edged lower on a mostly quiet World Agricultural Supply and Demand Estimates report published by USDA this morning. Notably, USDA trimmed production estimates for 2022 soybean production on lower acreage reported in the June 30 Acreage Report. USDA did not increase 2022 U.S. corn production estimates by as much as markets were expecting but the U.S. is still on track to harvest the fourth largest crop on record.

Spring wheat, soft winter wheat and durum production estimates were higher than expected by the trade, lifting 2022 wheat production estimates even though USDA-NASS cut national yields by 0.2 bushels per bushel to 48.0 bushels per acre.

USDA also made slight usage cuts to domestic corn, soybean and wheat ending stocks for the 2021/22 marketing year, alleviating some old crop supply concerns. USDA continued those cuts into the 2022/23 marketing year for soybeans on the smaller 2022 crop, left 2022/23 corn usage unchanged, and increased wheat exports for the 2022/23 marketing year.

“Today’s report was much more bearish – especially soybeans – than I had been expecting,” according to Farm Futures grain market analyst Jacqueline Holland. “I think we are starting to see USDA increase expectations for more buyer hesitancy amid a looming global recession and high commodity prices. That could drive down prices further.”

Overall, I think outside markets – primarily central bank interest rate adjustments and inflation management – are going to continue driving these commodity markets, Holland adds. The fundamentals still support profitable prices, but farmers may need to begin bracing for lower revenues in the 2022/23 marketing year, she says.

Corn

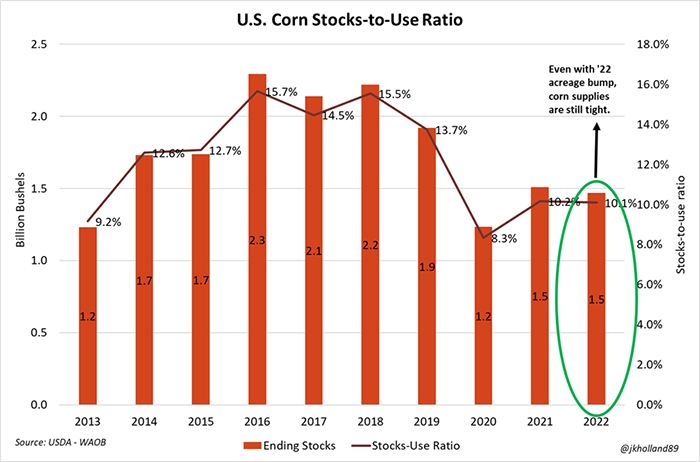

USDA’s outlook for corn assumes larger supplies and higher ending stocks. Beginning stocks moved 25 million bushels higher, which the agency attributes to reduced feed and residual use, as indicated in its Grain Stocks report at the end of June. Production for 2022/23 moved 45 million bushels higher, mostly matching analyst estimates of 14.520 billion bushels. USDA left yield estimates unchanged, at 177.0 bushels per acre. The season-average farm price slid 10 cents lower, to $6.65 per bushel.

Lower cattle on feed inventories as producers look to keep cattle off of burning pastures in the Plains were a primary driver for weakened 2021/22 corn usage rates, according to Holland.

“I thought it interesting that even with a 70-million-increase in 2022/23 beginning stocks on the 2022 harvest increase and larger old crop ending stocks, USDA did not increase any demand factors for corn,” she says. “That could suggest that USDA expects that high prices could start to drive some demand destruction in the upcoming marketing year – or at least slow down any expansion plans for corn end users for the next 12 months.”

“The larger U.S. corn crop helped push new crop ending stocks above pre-report expectations,” Holland says. “A larger than expected crop from Paraguay surprised markets, contributing to the bearish pressure felt across the corn complex today.”

But even with the production bumps, global usage is still expected to decline as high prices begin to push buyers out of the market, pushing ending stocks higher, Holland adds. “One bright note – corn export volumes out of Ukraine have been better than expected, which helped offset further demand losses on the global stage.”

Overseas production is trending lower, according to USDA. Most notable were reductions for Russia, the European Union and Kenya. Global stocks moved modestly higher, to 12.320 billion bushels – a bit above the average trade guess of 12.224 billion bushels.

USDA left 2021/22 production estimates in South America unchanged. That includes 2.087 billion bushels in Argentina and 4.567 billion bushels in Brazil.

Soybeans

USDA trimmed its soybean harvested area estimates by 2.6 million acres to 87.5 million acres. Because of that, the agency lowered its production estimates by 135 million bushels, for a new tally of 4.5 million bushels. Yield estimates are unchanged, at 51.5 bushels per acre.

“It was a bit of a bearish surprise that USDA increased old crop soybean stocks by 10 million bushels,” Holland says. “The trade had not been expecting USDA to cut 2022/23 soybean usage rates significantly even though 135 million fewer bushels are expected to be harvested from this year’s record crop.”

But Holland also points out that USDA bucked those sentiments and took a total of 75 million bushels of soybean usage out of the 2022/23 demand pipeline to keep ending stocks from falling. The larger than expected ending new crop volumes added on to the bearish pressure already at play in the soybean markets this morning, she says. This indicates that high soybean prices are likely to drive demand destruction in the new crop marketing year, with the export market taking the biggest hit.

“That could complicate the fall harvest season for U.S. soybean producers. If the market is not demand-driven at that point, growers are not as likely to enjoy the basis premiums of last year following the 2022 harvest,” Holland says. “However, if the export market decides it can afford to bid up prices – and provide more stiff competition to domestic soybean crush facilities – USDA may be forced to revise that figure higher in the coming months.”

Lower production was partly offset by higher beginning stocks, leaving USDA to lower 2022/23 supply estimates by 125 million bushels. Export potential dropped by 65 million bushels to 2.14 billion due to “lower U.S. supplies, increased South American supplies and lower global imports.” Ending stocks fell 50 million bushels since June to 230 million bushels.

The season-average price for soybeans in 2022/23 is forecast at $14.40 per bushel, which is 30 cents lower than USDA’s estimates from June. Soymeal prices are also trending lower, at $390 per short ton. Soyoil prices dipped a penny lower to 69 cents per pound.

World ending stocks decreased modestly, moving from 3,691 billion bushels in June down to 3.660 billion bushels in today’s report. South American production potential was steady to firm. Argentina’s crop moved slightly higher, to 1.617 billion bushels, while Brazilian production remained unchanged at 4.629 billion bushels.

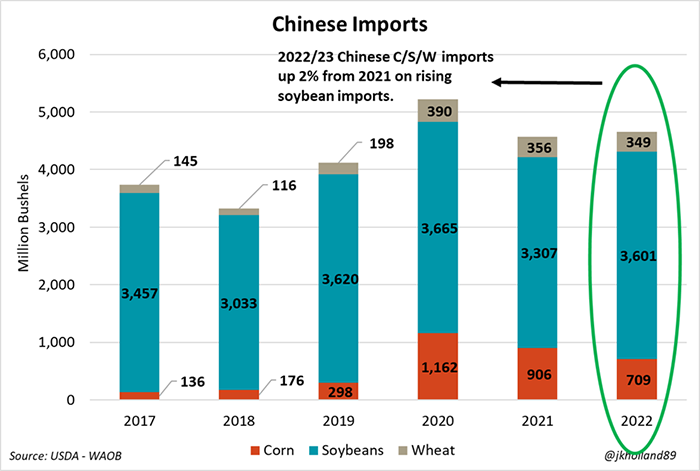

“USDA also cut both 2021/22 and 2022/23 soybean import forecasts for China, which squeezed bearish pressure into both old and new crop futures prices,” Holland says. “China’s soybean imports are still expected to be higher than year-ago volumes even with today’s minor cuts.”

Wheat

USDA raised its supply estimates for wheat by 44 million bushels to 1.781 billion bushels due to an uptick in harvested area and per-acre yields. The agency pegs winter wheat production at 1.201 billion bushels, plus another 503 million bushels for spring wheat.

USDA also raised its export forecast by 35 million bushels to 800 million for the 2022/23 marketing year, noting that a recent decline in prices makes U.S. grain more competitive overseas. The season-average farm price slid 25 cents lower to $10.50 per bushel.

“Winter wheat yields have taken turns trading off drought damage over the past two years,” Holland says. “USDA-NASS data found winter wheat yields in the Northern Plains and Pacific Northwest to be soaring above year-ago values, while hard red winter wheat yields in the Central and Southern Plains severely dropped off last year’s yields as last year’s drought shifted south into that region.”

Holland also points out that wheat demand had a couple bullish surprises for domestic markets, even though stocks were larger than the trade had expected due to the higher wheat production volumes.

“2022/23 seed and export volumes for wheat consumed 27 million bushels of the 34 million bushels added to beginning stocks from excessive old crop stocks and the upward revisions for the 2022 harvest,” she says. “That’s great news for U.S. wheat producers who are looking to sell wheat bushels off the combine right now into the export pipeline. It suggests they may have more profit opportunities to capitalize on in the coming weeks compared to last year.”

World ending stocks for 2022/23 increased slightly, from 9.804 billion bushels last month to 8.829 billion bushels. In contrast, analysts were expecting to see a small decline, with an average trade guess of 9.782 billion bushels.

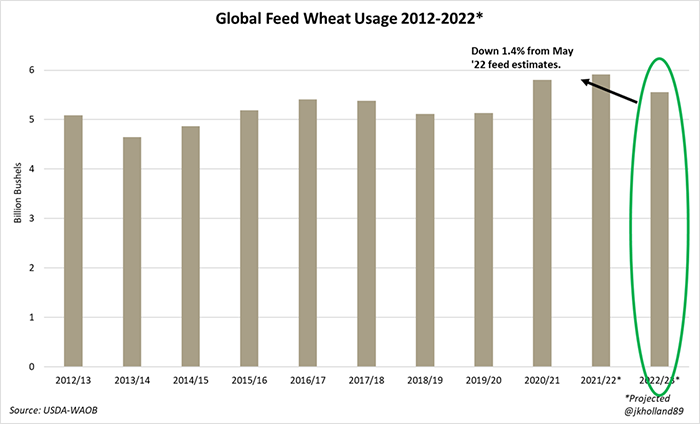

“Hot and dry weather in the European Union led USDA to large production cuts today, dropping 2022/23 harvest estimates by 73 million bushels to 4.93 billion bushels,” Holland says. “USDA continues to keep Ukraine’s wheat harvest at a conservative value, slashing another 73 million bushels of production from new crop estimates to 716 million bushels to account for the ongoing Russian invasion. Annual Ukrainian wheat production is down about 40%. Argentina also is expected to harvest a smaller wheat crop. Canada’s wheat crop will rebound this year after last year’s drought, but it still won’t be enough to stave off a slowdown in usage rates this year. USDA cut global domestic usage estimates – primarily for livestock feed – by 65 million bushels to reflect the crop shortfalls to 28.9 billion bushels.”

Read more about:

WASDEAbout the Author(s)

You May Also Like