The commodity price debate continues for yet another week. The clash between underlying bullish supply fundamentals for grain and oilseeds, spars with various nations' efforts to fight inflation either through higher interest rates or creative maneuvering to portray less demand.

As I pointed out in my blog last week, the question continues, are commodity prices at a point of further price selloff due to fears of global recession or are prices about to rebound and extend higher due to the reality of still tight global grain and oilseed supplies?

Who blinks first? The stare-down continues

The clash may continue for the short term as trade watches to see if inflation can come down. Some feel inflation likely only comes down if commodity prices come down on their own, or if interest rates go up to slow demand.

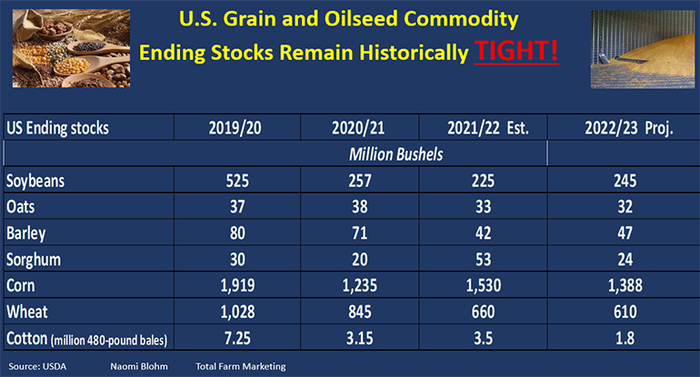

Taming demand is one aspect of the inflation fight and problem, but the other obvious exemplified underlying problem is the reality of TIGHT supplies of grain and oilseeds here in the United States and around the world. That is the underlying problem.

Smaller global grain supplies cannot be hidden

The world hoped Mother Nature would offer a perfect growing season for the entire Northern Hemisphere this summer and that record grain production would result, but that did not occur. Global satellite images this summer alerted the agricultural industry that the global crops were in peril due to extreme heat. That fact is what kept corn and soybean prices supported this summer. Within weeks combines will roll and will unveil that U.S. and global grain supplies are still on the historically low side, with ending stocks on the cusp of again trending lower.

The United States did not have record grain production this summer due to intense heat. The same is true for the European Union. The crop in Ukraine is lower because of the war and less acres were planted. The crop in China suffered intense heat and drought in some regions, with other regions receiving too much rain.

Bottom line, there is NOT a record crop from the Northern Hemisphere. The lower-than-expected supply story continues and cannot be concealed.

Can demand be curbed enough to offset the truth: low supplies

The cat is out of the bag. With countries around the world not able to magically produce any more grain than what Mother Nature created this summer, now you will see the creative hoops countries may jump through in an attempt to curb demand, and thwart an attempt to keep grain and oilseed prices from rallying higher.

Monday, Sept. 12 is the next USDA WASDE report. Looking back one month, the information from the August USDA report shows tight supplies and still historic tight carryout levels.

Monday’s USDA WASDE report has the potential for many surprises. On the supply side, U.S. corn yield is expected to get smaller, with much of this news likely priced in. U.S soybean yield is likely to show a slight increase on this report, and this news is also likely priced into the market.

Also relating to supply, the USDA has said that they feel they have enough data to be able to update planted acres and harvested acres on this report. Normally this type of update would occur on the October report, but they are offering this information one month early.

I find it to be interesting timing that they have computer capabilities to update acreage information one month early, meanwhile, the USDA can’t give us weekly export figures due to the inability over that particular computer system to compile that information together.

So, on the demand side, we are in the dark about potential export demand due to not having access to weekly export sales for the past few weeks. On Monday, trade will just have to “go with” whatever export demand figures are pegged on Monday’s report.

Some are citing the USDA to potentially drop U.S. soybean export demand by 100 to 200 million bushels, with thoughts that South America might gain that business instead. Which if true, might push ending stocks closer to 350 to 450 million bushel carryout and would likely instantly cease any potential rally this market may have had in the short term.

Some suggest that due to a slower Chinese economy, they will import less commodities in the short term also. The Chinese economy is limping along due to rolling city-wide Covid lockdowns which likely helps to slow Covid, but also slows their economy, and also meets another likely objective, slowing commodity demand.

This notion was highlighted this week when news emerged that Chinese purchasing of grains had indeed pulled back with Chinese customs data showing that the country imported 7.16 million metric tons of soybeans in August, which is the lowest level of soybean imports since 2015.

Grain traders are now questioning what weaker Chinese demand may mean on upcoming USDA reports. Is it a temporary demand cut? Or will the rolling Covid lockdowns continue within China, to actually make a legit, lasting notch out of demand?

With elections coming up in the United States and China, it seems likely that the fight to lower inflation may continue in the short term. Looking abroad on Oct. 16, China’s leaders are proposed to meet in Beijing to hold their 20th National Congress. The national congress is held every five years and determines the next group of leaders for the ruling party. This gathering has additional merit this year as China will also likely signal its upcoming economic plans and policies, and the world will watch to see if a date might be released on when China might ease its zero-Covid policy.

The clash may continue for the short term as trade watches to see if inflation and commodity prices can come down. Or, will harvest in the Northern Hemisphere exemplify further the reality of the tight grain supply situation the world continues to face?

Taming demand is one aspect of the problem, but the other exemplified underlying problem is the reality of TIGHT supplies of grain and oilseeds here in the United States and yet around the world. THAT is the underlying problem. That problem does not get fixed quickly. And Mother Nature is the only one that can fix it.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like