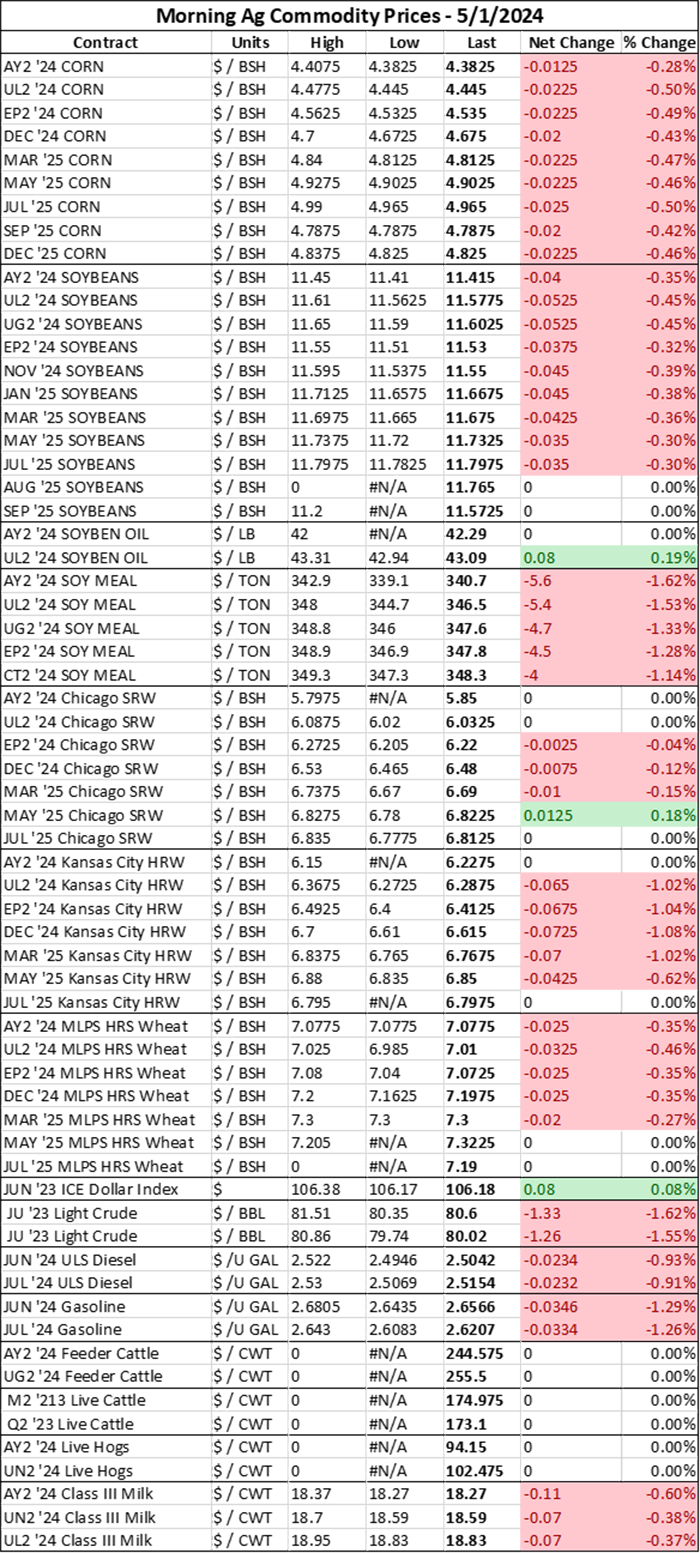

At a Glance

- Corn down 1-2 cents

- Soybeans down 3-5 cents; Soyoil up $0.10/lb; Soymeal down $4.70/ton

- Chicago SRW wheat up 1-2 cents; Kansas City HRW wheat down 5-6 cents; Minneapolis spring wheat down 2-3 cents

Prices updated as of 6:55am CDT.

Feedback from the Field

Were you able to dodge showers over the weekend and keep your planter rolling?! Share your insights with us in our ongoing Feedback from the Field survey!

Feedback from the Field is an open-sourced, ongoing farmer survey of current crop and weather conditions across the Heartland. If you would like to participate at any time throughout the growing season, click this link to take the survey and share updates about your farm’s spring progress. I review and upload results daily to the FFTF Google MyMap, so farmers can see others’ responses from across the country – or even across the county!

Biofuel production and capacity

Yesterday’s monthly Biofuels Production and Capacity report from the U.S. Energy Information Administration (EIA) provide little new news for the soy industry, but plenty of good signs for corn ethanol production. The report chronicled February 2024 production and capacity and provides the most reliable source of feedstock usage for bio-based fuel production.

February is always a tricky reporting month due to its short duration – even with a leap day thrown in this year. But the soybean complex still struggled to glean bullish news from this month’s data release. Biodiesel capacity dropped 4% lower on the month to 1.984 billion gallons per year in February. During that time, renewable diesel capacity was unchanged from the prior month at 3.857 billion gallons and fuel ethanol capacity increased fractionally, by 50 million gallons to 17.880 billion gallons.

Soybean oil feedstocks used at bio-based renewable diesel plants shrunk 7% from the previous month to 888 million pounds. Vegetable oil use as a whole trended lower for biofuel feedstocks in February 2024, with canola oil and corn oil consumption dipping 21% and 6% lower, respectively, on the month.

However, 247 million more pounds of corn were consumed in February 2024 for fuel ethanol than in the prior month, bringing the monthly total for corn to 24.947 billion pounds. That’s 12% more corn consumed for biofuels than in the prior year, suggesting that ethanol production continues to run strong.

Grain sorghum consumption for biofuels also increased in February 2024, rising 18% on the month to 90 million pounds. Tallow from beef and white grease feedstocks also trended 13% and 21% higher, respectively, than the prior month.

This data confirms a trend we’ve been consistently watching over the past six months or so – corn consumption for fuel ethanol continues to run ahead of expectations. In the renewable diesel sector, waste oils, fats, and greases are increasingly taking market share of total feedstocks used for bio-based diesel production, as vegetable oils take a backseat.

But don’t throw the baby out with the bathwater – there are a handful of new soybean crush plants slated to open later this summer or early this fall to supply soybean oil as feedstock to bio-based diesel production plants. Soybean oil is much more effective for new bio-based diesel plants to work with at start-up than other waste oils, fats, and grease alternatives.

Even if this report didn’t necessarily seem to favor soybean markets, we still have a lot of time left in this ongoing expansion game for those numbers to shift.

Corn

Corn prices fell $0.01-$0.02/bushel this morning, sending nearby May24 futures to 4.39/bushel, most actively traded Jul24 contracts to $4.4525/bushel, and new crop Dec24 prices to 4.6825/bushel at last glance.

Corn markets yawned at rain showers forecasted for the Plains and Upper Midwest today. However, if soils are dry enough in the Eastern Corn Belt, enough planting progress could be made today to offset rain delays in the west.

A two-day oilseed and dock workers’ strike was lifted in Argentina yesterday, allowing trade flows of corn and soybeans to return to normal shipping patterns.

Soybeans

Soybean prices fell $0.01-$0.03/bushel lower this morning, as markets breathed a sigh of relief that a workers’ strike in Argentina had ended. The lower prices were also antagonized by a stronger dollar overnight that prevented U.S. soybean supplies from competing with robust Brazilian soybean export paces as well as losses in the energy sector.

Nearby May24 futures held steady at $11.455/bushel as a result. Most actively traded Jul24 contracts dipped to $11.6075/bushel. New crop Nov24 prices fell to $11.5825/bushel.

Soybean oil traded lower yesterday, which was no doubt exacerbated by less than favorable EIA data mentioned earlier in this report. But some profit-taking appears to be reviving soyoil prices somewhat this morning.

Soymeal futures plunged following the news that the strike at Argentina’s Rosario-based port of San Lorenzo had been lifted. Argentina is the world’s largest soymeal exporter, so the strike threatened to disrupt global trade flows and could have led to an uptick in U.S. soymeal exports, had it lasted longer.

Wheat

Chicago wheat markets moved a penny or two higher this morning, but Kansas City and Minneapolis futures struggled against a stronger dollar, falling $0.02-$0.05/bushel in the early morning trading session.

Markets are evaluating whether rains forecasted in Russia this week will be enough to salvage crop conditions for the world’s largest wheat exporter. The uptick in Chicago prices suggests some traders are hedging Paris wheat (soft wheat) against these weather worries, but lower Kanas City prices tell us that the market thinks that upcoming rain showers in the Plains will improve U.S. winter wheat conditions enough to offset some of the worries about Russia’s crops.

"The market is trying to figure out whether there's any issue with Russian production," Commonwealth Bank analyst Dennis Voznesenski told Reuters. "If it turns out that everything is fine in a week or two's time, it'll be depressive on pricing."

“Northern Hemisphere harvests will be underway over the coming months, keeping the market flush with supply.”

Meanwhile, strong Black Sea wheat exports continue to weigh on markets. Ukraine’s grain exports rose in April, even amid Russian attacks. Russia also continues to ship massive export volumes, which is preventing wheat prices from moving up this morning.

Weather

Today’s round of severe thunderstorms will again take place in the Plains as heavy rains and severe storms are forecasted to stretch from Eastern Nebraska and Western Iowa all the way south into Texas’s Gulf Coast, according to NOAA’s short-range forecast. More showers and less severe thunderstorms are expected in the Northern Plains and Central Mississippi River Valley.

Yesterday’s showers may not have resulted in too much accumulation, but it is more likely that today’s rain events will. Eastern Nebraska, Western Iowa, parts of Kansas, Oklahoma, and Texas could see up to two inches of accumulation over the next 24 hours. The surrounding regions could accumulate up to a half inch of precipitation during that time.

Showers are expected to pop up and linger over the Heartland on and off over the next couple days. Temperatures will continue to run warm this week, with highs in the 50s in the Dakotas, Minnesota, and Pacific Northwest and into the 60s and 70s in the rest of the Heartland through Friday.

However, the key benefit to these late week showers is that it will provide winter wheat crops and pastures in the Southern Plains with more moisture, which is sorely needed as 30% of winter wheat acreage in the U.S. currently resides in D1-D4 drought conditions.

Temperatures will continue to run above average into early next week, according to NOAA's 6-10-day outlook. The Gulf Coast is likely to see the highest chances for warmth during that time. But chances for rain will also continue to run higher than normal across the Plains, Midwest, and Pacific Northwest early next week, with the highest chances lingering over the PNW and Northern Border.

Warm temperatures will continue to stick around the Heartland through the middle of next week in NOAA’s 8-14-day forecast, though we could see the highs retreat slightly from earlier in the week. The Gulf Coast will continue to see warmest temperatures during that time. Thankfully, showers are showing a chance of retreating in the Plains by mid-week, though above average chances continue to linger over the Northern Plains, Upper Midwest, and Eastern Corn Belt.

That means farmers will likely continue to dodge showers throughout the next week as they race to finish planting for the 2024 season. The warm temperatures should help to speed up drying out wet soils, though it will likely continue to be a battle against the rain.

Financials

S&P 500 futures drifted 0.35% lower to $5,049.25 this morning as markets await the results from the Federal Reserve’s Federal Open Market Committee (FOMC) meeting due to conclude this afternoon.

Markets are hoping the Fed will provide more guidance on interest rate changes following the meeting’s conclusion. Fed chair Jerome Powell will also provide more guidance about where the Fed sees the economy going ahead of the summer months.

Inflation rose in March 2024, reversing an earlier trend of cooling that had markets eager to see the Fed reduce interest rates earlier this year. But as inflation has remained above the Fed’s desired 2% benchmark target, markets are increasingly making peace with the fact that interest rates will likely remain unchanged around the 5.3% level through most of 2024.

The Wall Street Journal has a great comprehensive preview of what to expect ahead of Fed Chair Powell’s comments expected later today. I highly recommend it if you want more of the nitty gritty details surrounding all of the Fed action and market reaction to today’s FOMC meeting.

What else I’m reading at www.FarmFutures.com this morning:

Here are Naomi Blohm’s tips and tricks to capturing summer corn rallies.

Policy editor Josh Baethge summarizes the recent policy updates to bovine influenza and sustainable aviation fuel.

Analyst emeritus Bryce Knorr is watching these four marketing items as peak planting season ramps up.

Just like in the NFL draft last week, AgMarket.Net hedging strategist Tyler Schau recommends farmers stick to their strategy when it comes to grain marketing plans.

About the Author(s)

You May Also Like