At a Glance

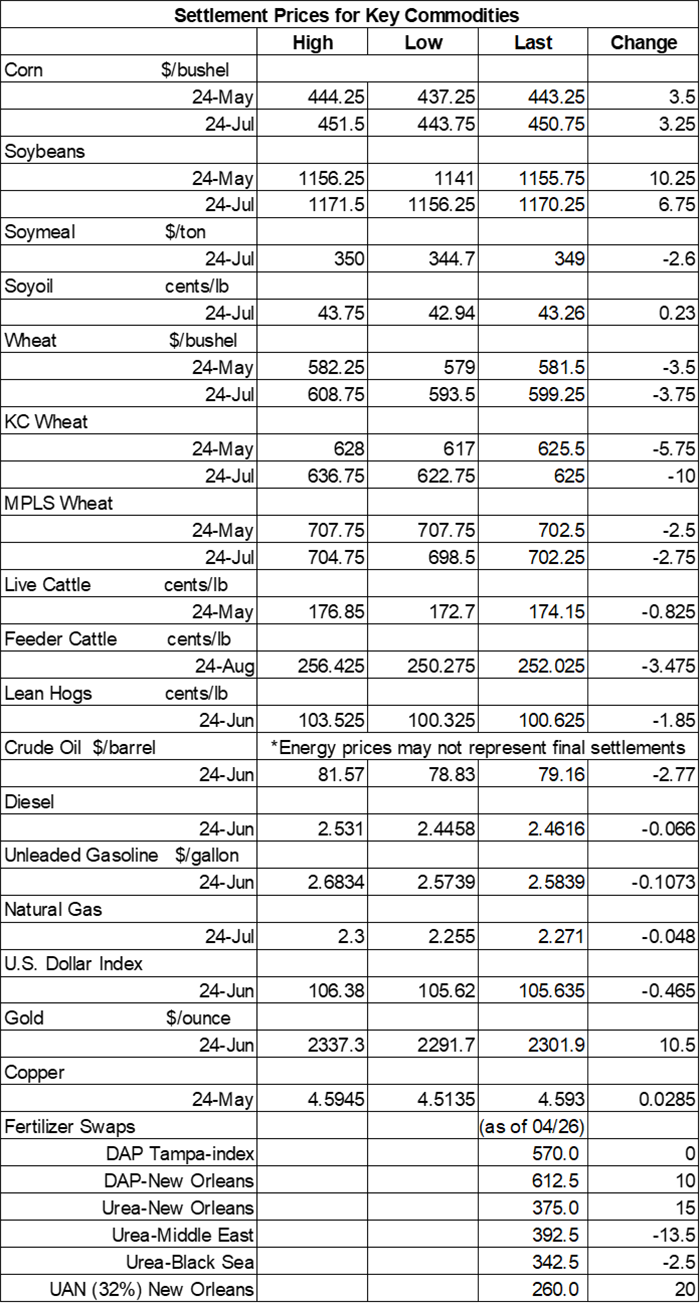

- Corn and soybean prices each shift around 0.75% higher on Wednesday.

- Wheat prices faced variable cuts, with most contracts down 0.5% to 1.5%.

- Plus: Brace for another massive soybean crushing report?

Grain prices were mixed as traders assessed the next round of rains moving through the central U.S. later this week, which could help winter wheat quality and yield potential while generating some delays for corn and soybean plantings. Corn and soybean prices each tracked around 0.75% higher, while wheat prices found moderate cuts following a round of technical selling.

Rains stretching between Texas and Louisiana up to Nebraska and Iowa is likely to deliver another 1” to 2” or more between Thursday and Sunday, per the latest 72-hour cumulative precipitation map from NOAA. Further out, NOAA’s new 8-to-14-day outlook predicts seasonally wet weather for most of the Corn Belt between May 8 and May 14, with warmer-than-normal temperatures likely for the eastern third of the country later this month.

On Wall St., the Dow improved 184 points in afternoon trading to 38,000 after the Federal Reserve declined to initiate an interest rate cut as it hopes to bring inflation back down to a target of 2%. Energy futures slumped into the red, with crude oil stumbling 3.75% lower this afternoon to $78 per barrel, which was partly spurred by rising domestic inventories. Diesel dropped 2.75%, while gasoline lost more than 4%. The U.S. Dollar softened slightly.

On Tuesday, commodity funds were net sellers of all major grain contracts, including corn (-2,000), soybeans (-8,000), soymeal (-2,000), soyoil (-4,500) and CBOT wheat (-2,000).

Corn

Corn prices benefited from a round of technical buying on Wednesday as traders assessed the latest mid-range weather forecasts, which suggest plenty of additional rain coming to the Midwest over the next several days. May futures added 3.5 cents to $4.43, with July futures up 3.25 cents to $4.50.

Corn basis bids were steady to mixed across the central U.S. after trending as much as 3 cents higher at an Iowa river terminal and as much as 2 cents lower at an Iowa ethanol plant on Wednesday.

Ethanol production in the week through April 26 improved to a daily average of 987,000 barrels but remained below the 1-million-barrel-per-day benchmark for the third consecutive week, according to the latest data from the U.S. Energy Information Administration, out Wednesday morning. Ethanol stocks tightened by 1% last week.

Prior to Thursday morning’s export report from USDA, analysts expect the agency to show corn sales ranging between 25.6 million and 63.0 million bushels for the week ending April 25.

Ukraine’s 2023/24 grain exports so far have included corn sales totaling 901.5 million bushels, plus another 580.6 million bushels in wheat sales. Ukraine is among the world’s top exporters of both commodities as it deals with ongoing Russian attacks against grain silos and port infrastructure.

Grain traveling the nation’s railways saw another 20,236 carloads on the move this past week. That brings cumulative sales for 2024 to 348,033 carloads, which is 0.8% higher year-over-year so far.

“As planting begins, it is an excellent time to review the various cash grain contracts available for producers to incorporate into their crop marketing plan,” according to Mississippi State University Extension specialist William Maples. “When considering contracts, the producer must understand the special features of each contract and the type of risk it is managing.” Maples walks through several potential strategies – click here to learn more.

Corn settlements on Tuesday were for 257,139 contracts.

Soybeans

Soybean prices captured gains of around 0.75% following a round of technical buying on Wednesday. May futures rose 10.25 cents to $11.5575, with July futures up 6.75 cents to $11.6975.

The rest of the soy complex was mixed. July soymeal futures shifted 0.75% lower, while July soyoil futures tracked 0.5% higher.

Soybean basis bids shifted 6 cents higher at an Iowa river terminal while holding steady elsewhere across the central U.S. on Wednesday.

Ahead of tomorrow morning’s export report from USDA, analysts think the agency will show soybean sales ranging between 3.7 million and 33.1 million bushels for the week ending April 25. Analysts also expect to see soymeal sales ranging between 150,000 and 400,000 metric tons, plus up to 10,000 MT of soyoil sales.

As another crop season kicks off, Farm Futures grain market analyst Jacqueline Holland is assembling a new batch of Feedback from the Field updates, which is populated with farmer comments from around the Heartland. Click this link to take the survey and share updates about your farm’s spring progress. Holland reviews and uploads results daily to the FFTF Google MyMap, so farmers can see others’ responses from across the country.

The U.S. Treasury Department and IRS announced new guidelines regarding tax credits designed to incentivize production of sustainable aviation fuel. “USDA will continue to work with our federal agency partners to expand opportunities in the future for climate smart agriculture in producing sustainable aviation fuel,” according to Agriculture Secretary Tom Vilsack. However, the American Soybean Association expressed concerns that some farmers will not be able to meet guideline requirements. Click here to learn more.

A survey of analysts suggests that USDA could show a March soybean crush totaling 205.965 million bushels when it releases its next monthly report later today. If realized, that would be 6.2% above February’s crush. Soyoil stocks are estimated to reach 2.294 billion pounds as of March 31.

Soybean settlements on Tuesday were for 235,166 contracts.

Wheat

Wheat prices suffered a moderate technical setback on Wednesday that was partly spurred by recent yield-refreshing rains in the U.S. Plains. July Chicago SRW futures fell 3.75 cents to $5.9950, July Kansas City HRW futures lost 10 cents to $6.2525, and July MGEX spring wheat futures dropped 2.75 cents to $7.0150.

Prior to Thursday morning’s export report from USDA, analysts expect the agency to show wheat sales ranging between 3.7 million and 25.7 million bushels in the week through April 25.

Egypt’s supply minister reported that the country’s strategic wheat reserves are sufficient for the next three months, with its vegetable oil supplies sufficient for nearly five and a half months. Egypt is routinely the world’s No. 1 or No. 2 wheat importer.

Algeria issued an international tender to purchase 1.8 million bushels of soft milling wheat from optional origins that closes on Thursday. Algeria has often bought more than the nominal amount listed in similar tenders. The grain is for shipment starting in June, depending on where it is sourced.

CBOT wheat settlements on Tuesday were for 157,718 contracts.

About the Author(s)

You May Also Like