Updated 11:44 a.m.

Grain futures are mixed this morning following a very surprising USDA report that ran completely against expectations. Soybean seedings plunged while corn ground rose from the agency’s estimates earlier this month.

Corn and wheat prices fell sharply immediately following the report, with soybean prices climbing around 1% Friday morning.

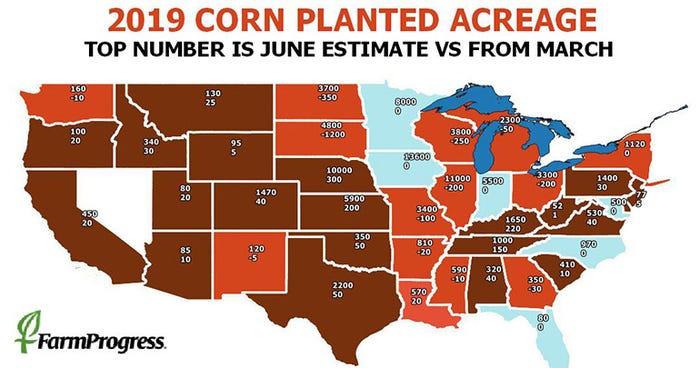

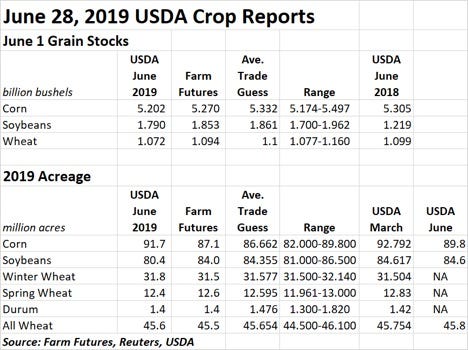

Planted corn acres this year are expected to reach 91.7 million acres, according to USDA. That tally is 3% higher than 2018’s total. Expected harvested acres are moderately lower, at 83.6 million acres, but still 2% above last year.

Analysts, in contrast, were expecting USDA to show 86.662 million acres in its annual acreage report, including a projection of 87.1 million acres from Farm Futures, which regularly participates in these surveys.

“A footnote in today’s acreage report encapsulates the debate that should rage in the market in coming days,” according to Farm Futures senior grain market analyst Bryce Knorr. “It noted that only 83% of the corn crop was planted during the period when USDA surveyed growers. What happened to those 15.6 million acres will play a large role in determining where prices are headed in the next year. Progress in key states like Illinois was even slower, yet the agency reduced its estimate for the Land of Lincoln by just only 200,000 from the 11.2 million intended in March.”

A re-survey of slow-planting states seems likely, unless USDA opts to wait for farmers to certify their acres with the Farm Service Agency, which must be done by July 15, Knorr adds.

“USDA normally doesn’t release its first report on certifications until the afternoon its August production, supply and demand report comes out,” he says. “The FSA certifications will be used to determine payments in the second round of the Market Facilitation Program, so there’s a chance prevent plant data will come out earlier than normal. USDA has a tendency to over-estimate corn acres in this June report during wet years, so revisions to the final numbers are quite possible.”

In the meantime, some chart indicators have turned bearish for corn, Knorr says. But even with a lot of uncertainty, it may not make sense to chase this market lower unless you’re very confident about yield potential, he says. But if USDA is correct, and yields don’t suffer too much, the top could be in for this market.

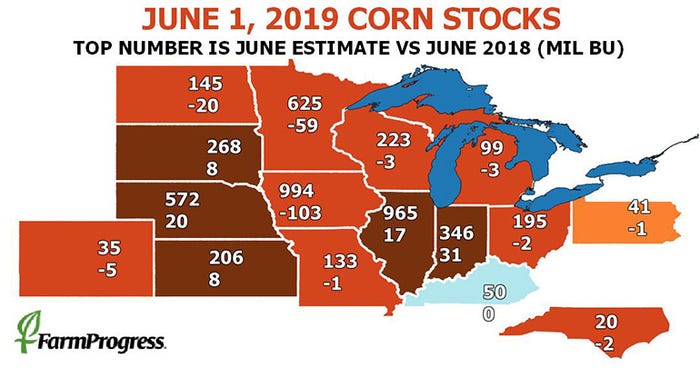

Domestic corn stocks still took a dip year-over-year, moving to 5.202 billion bushels, versus 5.305 billion bushels the same time a year ago. Analysts were actually predicting a small increase, to 5.332 billion bushels.

“Lost in the acreage news for corn was a friendly stocks number, which means feed usage could be better than the government previously estimated, at least through the first three-quarters of the marketing year,” Knorr says.

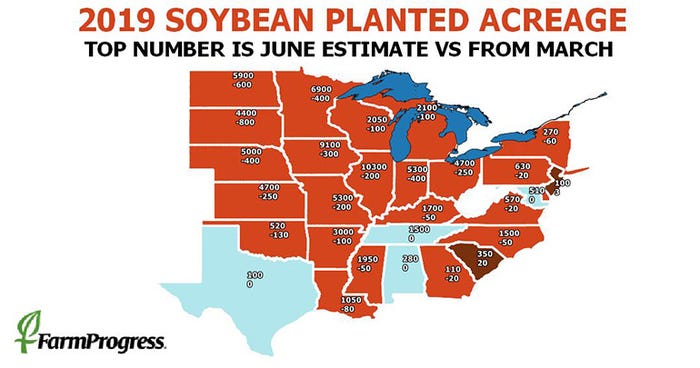

USDA pegged 2019 U.S. soybean acres well below analyst expectations, meantime, with a total of 80.4 million acres. The average trade guess was for 84.355 million acres, including a Farm Futures estimate of 84.0 million acres.

“The acreage news for soybeans was almost as shocking as for corn,” Knorr says. “Again, there were so many unplanted acres when the survey was conducted, it’s hard to know what the final figure will be. Supplies are burdensome, but this report may shield soybeans from the worst. Today’s purchase by could give the market a little more confidence depending on how the G-20 talks turn out.”

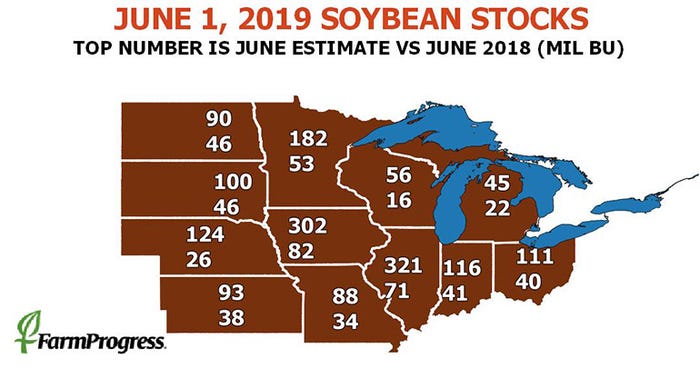

U.S. soybean stocks moved moderately higher year-over-year, from 1.219 billion bushels in June of 2018 up to 1.790 billion bushels. Analysts were expecting an even bigger bump, with an average trade guess of 1.861 billion bushels.

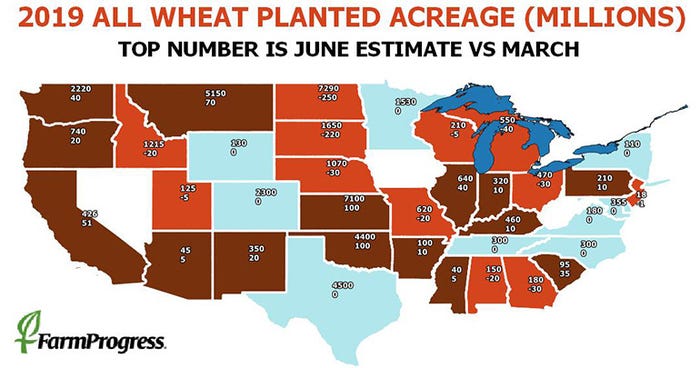

USDA’s assessment for 2019/20 all-wheat U.S. acres declined slightly, to 45.6 million acres after the agency increased estimates for winter wheat acres but lowered estimates for spring wheat acres. Analysts expectations were nearly on the nose here, with estimates of 45.654 million acres, including a Farm Futures projection of 45.5 million acres.

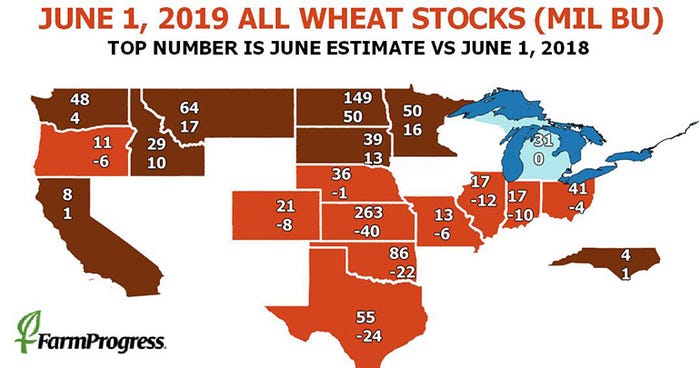

“Today’s numbers for wheat weren’t bearish, but the market sold off anyway due to the drop in corn,” Knorr says. “Add in a little harvest pressure, and wheat could be choppy in the near-term while the rest of the market gets sorted out.”

Domestic wheat stocks declined slightly year-over-year, moving from 1.099 billion bushels in 2018 down to 1.072 billion bushels. Analysts were expecting a fractional increase, with an average trade guess of 1.100 billion bushels.

About the Author(s)

You May Also Like