Anyone hoping for a positive round of export sales data will have to wait another week after looking at the latest USDA data, out Thursday morning.

“Export sales out this morning were mixed but provided little in the way of bullish support to markets badly in need of a boost,” according to Farm Futures senior grain market analyst Bryce Knorr.

China booked a couple of cargoes last week, including both old and new crop soybeans, Knorr says. But buyers so far aren’t responding to Beijing’s signals they can avoid tariffs on new purchases, he says.

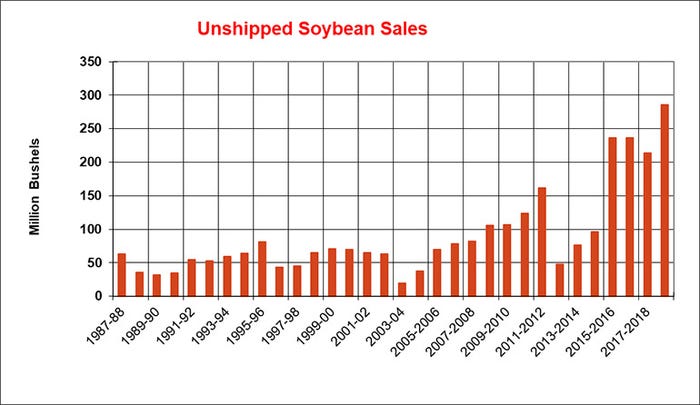

“While Chinese and U.S. negotiators tried to make nice after talks this week ended sooner than expected, news the next round of discussions won’t be held until September was a reminder of the trade war’s impact on soybean growers,” he says. “China still has 156 million bushels of old crop purchases made as a goodwill gesture after the cease-fire in the dispute, with time running to get all those shipped out by Aug. 31.”

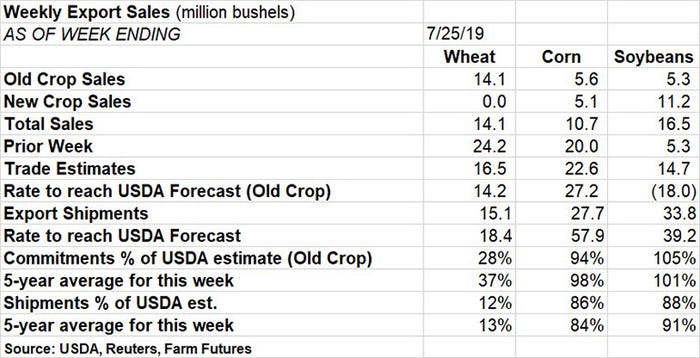

Soybeans saw 5.3 million bushels in old crop sales for the week ending July 25, plus another 11.2 million bushels in new crop sales, for a total of 16.5 million bushels. That was well above the prior week’s dismal tally of 16.5 million bushels and slightly ahead of trade estimates of 14.7 million bushels.

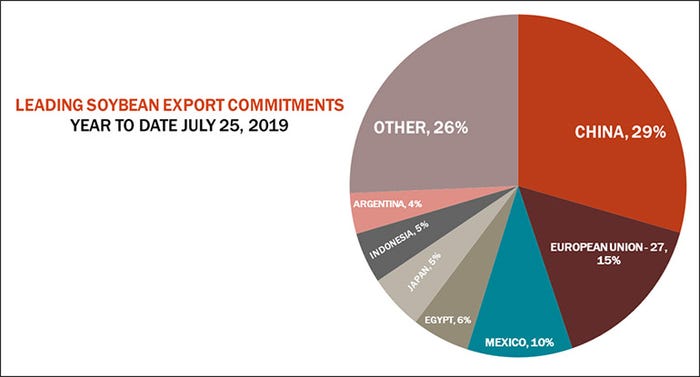

Soybean export shipments were for 33.8 million bushels, a bit behind the rate needed to match USDA forecasts of 39.2 million bushels. With a month to go in the 2018/19 marketing year, China leads all destinations for U.S. soybean export commitments, with 29% of the total. Other top destinations include the European Union (15%), Mexico (10%) and Egypt (6%).

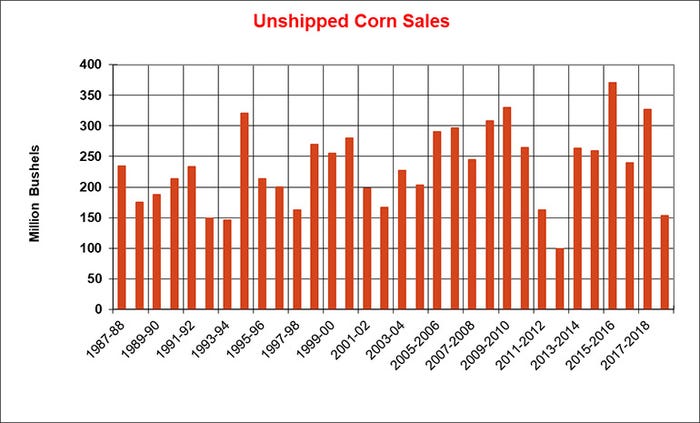

Corn exports found 5.6 million bushels in old crop sales and 5.1 million bushels in new crop sales last week, for a total of 10.7 million bushels. That was nearly half of the prior week’s tally of 20.0 million bushels and well below trade estimates of 22.6 million bushels. The weekly rate needed to match USDA forecasts moved higher, to 27.2 million bushels.

“Corn business remains disappointing as buyers either wait for lower prices or turn to the competition for what they need,” Knorr says. “The total for the 2018 crop is likely to be revised lower again when USDA updates its supply and demand balance sheet Aug. 12.”

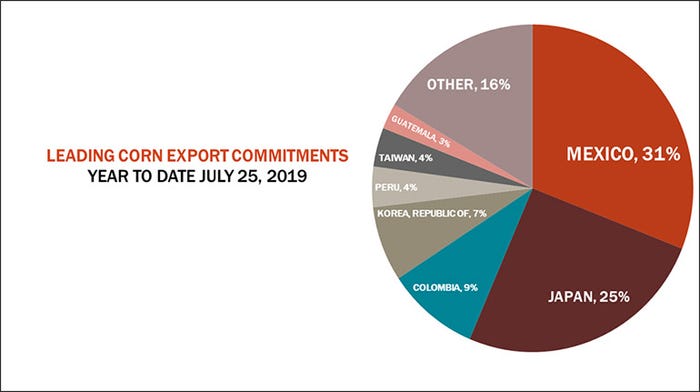

Corn export shipments were for 27.7 million bushels, pushing the rate needed to match USDA forecasts up to 57.9 million bushels. As the 2018/19 marketing year winds down, Mexico remains the No. 1 destination for U.S. corn export commitments, with 31% of the total. Other leading destinations include Japan (25%), Colombia (9%) and South Korea (7%).

Wheat exports tallied 14.1 million bushels of old crop sales last week, falling below the prior week’s total of 24.2 million bushels and trade estimates of 16.5 million bushels. The weekly rate needed to match USDA forecasts remains a manageable 14.2 million bushels for now.

“Export sales for wheat were in line with the rate needed to reach USDA’s forecast for the 2019 marketing year but fell off noticeably from the previous week,” Knorr says. “That’s been the patter in the first two months of the marketing year – good one week, meh the next.”

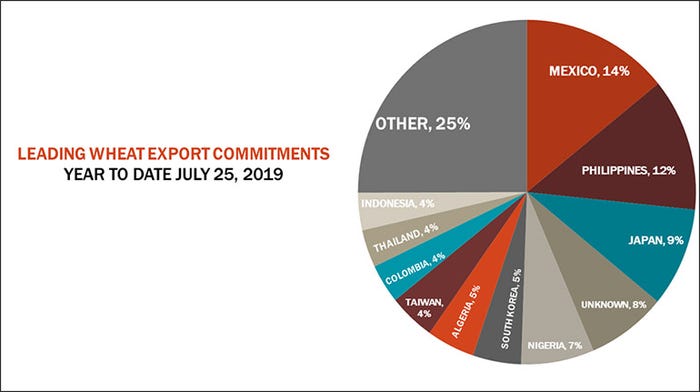

Wheat export shipments fared a bit better, at 15.1 million bushels. Two months into the 2019/20 marketing year, Mexico leads all destinations for U.S. wheat export commitments with 14% of the total. Other top destinations include the Philippines (12%), Japan (9%), unknown destinations (8%) and Nigeria (7%).

Click on the download button below for more information.

About the Author(s)

You May Also Like