Worries over 2019 U.S. grain production potential kept prices buoyant early in Thursday’s session, but the latest round of demand-side data from USDA this morning after the agency released its latest weekly export report, which covers the week ending June 6.

“Export business last week wasn’t terribly impressive, but the market isn’t focusing on demand right now with supply considerations in the forefront due to falling acreage forecasts for corn and perhaps soybeans,” says Farm Futures senior grain market analyst Bryce Knorr.

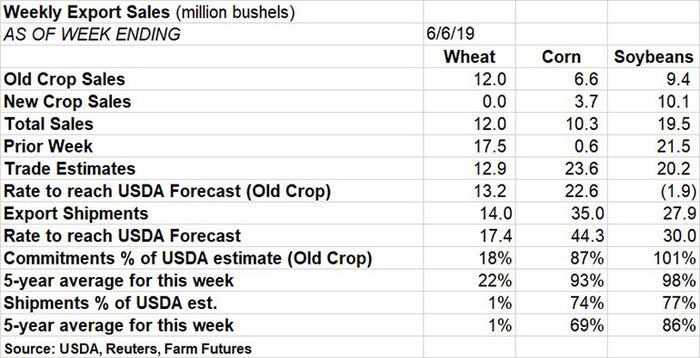

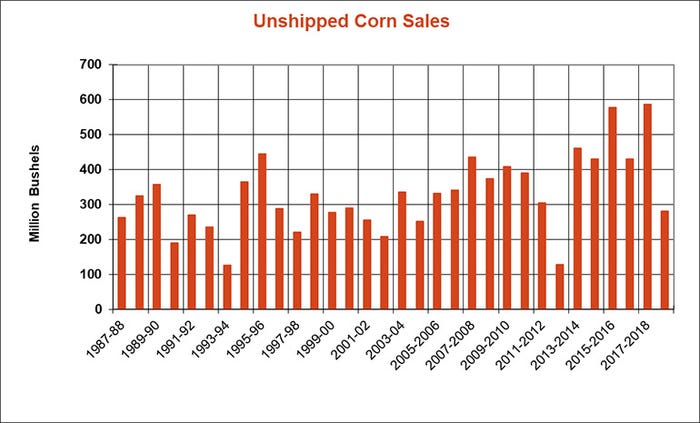

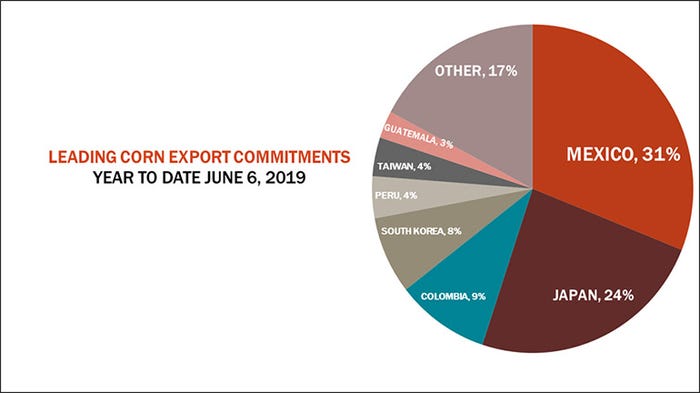

Corn exports notched 6.6 million bushels in old crop sales last week, plus another 3.7 million bushels of new crop sales, for a total of 10.3 million bushels. Old crop sales easily bested the prior week’s dismal tally but remained 64% down from the four-week average. Total sales also slumped below trade estimates, which ranged between 13.8 million and 33.5 million bushels. Japan, unknown destinations, Colombia and Taiwan were among the top buyers.

Corn export shipments were more robust last week after reaching 35.0 million bushels – enough to push 15% ahead of the prior week’s total but still down 18% from the four-week average. Japan was the No. 1 destination, with 12.7 million bushels, followed by Mexico (10.0 million), Colombia (3.8 million) and Taiwan (2.6 million).

“Export business for corn picked up a little, but only because last week’s total was negative,” Knorr says. “Higher prices and lack of new crop availability is sending customers to other suppliers already, with Brazilian growers benefiting as they get ready to harvest a huge crop this summer. This rationing process will help stretch leftover 2018 crop supplies until new crop in the U.S. is harvested, which likely will be later than normal.”

How much rationing – and how high corn prices go – ultimately will be decided by just how small the crop is, Knorr adds, but that won’t be known until combines start rolling in the fall.

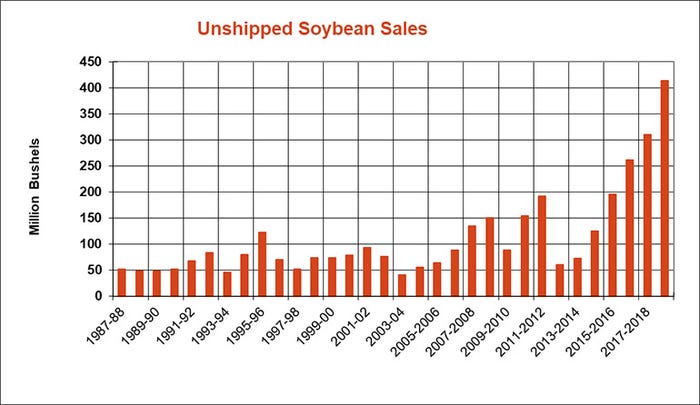

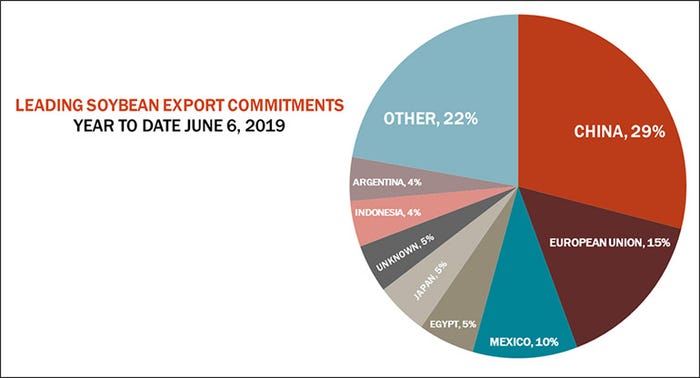

Soybean exports found 9.4 million bushels in old crop sales and 10.1 million bushels of new crop sales for a total of 19.5 million bushels last week. That dipped slightly below the prior week’s total of 21.5 million bushels but stayed in the middle of trade estimates, which ranged between 11.0 million and 29.4 million bushels. Top buyers included Egypt, Taiwan, Japan and Pakistan. China also accounted for a small piece of the pie, with 2.7 million bushels.

“China continues to pick up a soybean cargo here and there, and even booked some sorghum,” Knorr says. “But these dealers were merely switched by merchandisers from sales previous listed as going to “unknown destinations” so they don’t have a real impact on total exports.”

The larger question, Knorr says, is what Chinese buyers (mostly state-owned grain companies) will do with the 233 million bushels of outstanding sales that are still on the books.

“News reports today indicated those companies are trying to delay the shipments, though not outright cancel them, with talks between President Trump and President Xi of China at the G-20 summit later this month a potential make-or-break moment in the trade war,” he says.

Soybean export shipments fared better, at 27.9 million bushels – trending 40% above the four-week average. China led all destinations, with 14.8 million bushels. Other top destinations included Japan, Mexico, Bangladesh and the Netherlands.

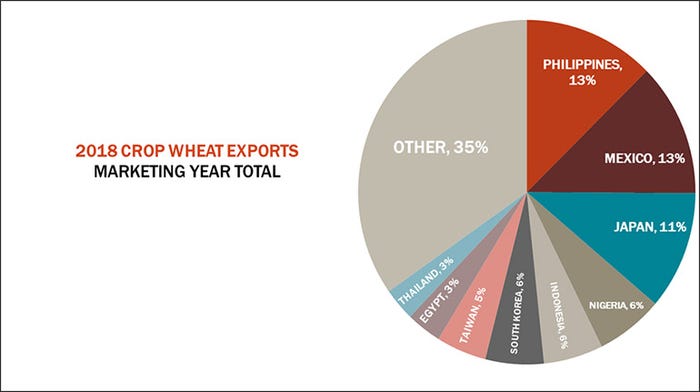

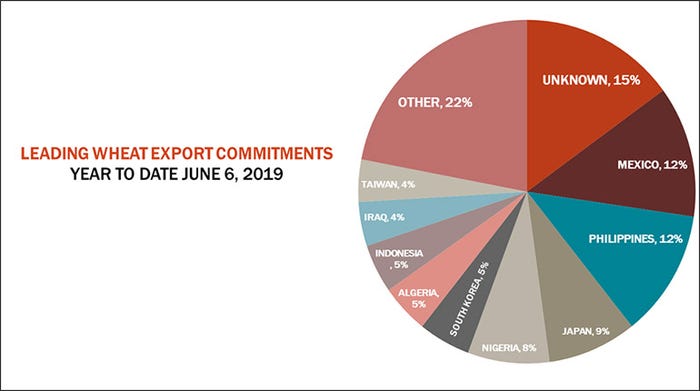

Wheat’s marketing year rolled over June 1, landing small net increase after sales of nearly 12.0 million bushels to Japan, Mexico, Taiwan, Iraq and Vietnam were largely offset from reductions for unknown destinations, the Philippines and South Korea. The trade expected USDA to report wheat sales totaling between 7.3 million and 18.4 million bushels.

USDA carried over another 58.3 million bushels in sales from the 2018/19 marketing year, which ended May 31.

“Mexico and the Philippines ran neck and neck as the leading buyers last marketing year, but 35% of the total went to “others” as the wheat market remains highly fragmented due to a lot of competition around the world,” Knorr says. “But with Australia having more problems with El Niño this year and Canada also dry, U.S. sales could have some hope in the year ahead.”

About the Author(s)

You May Also Like