In my April 15 column Rally Hopes Aren't Dead Yet, I noted how development of La Niña this summer would increase odds for lower than normal 2024 yields. Average corn yields could falter to 172 bushels per acre, based on trends seen in previous cooling episodes of the equatorial Pacific over the past 75 years. But if the current El Nino warming cycle ends only to get stuck in neutral, yields could improve to 183 bpa, better than the 179 statistical trend in recent years.

As I also pointed out, these are averages and far from a slam-dunk guarantee.

Some La Niña summers produce big yields. Still, lower yields typically mean higher prices and better rally opportunities for pricing new crop – and old crop as well for those still holding 2023 inventory.

Trouble is, prices are only one metric, and not the best one. What about prospects for a farm’s true bottom line: profits? Good prices may not mean much for producers who don’t harvest enough to pay the bills, even without help from crop insurance and government farm programs.

For answers, I spun the wheel of fortune. No, I’m not advising anyone to take a grubstake to Vegas or the nearest casino and bet it on a game of chance. Instead I used what’s known as a Monte Carlo analysis to game out thousands of profit – or loss – scenarios that might develop from different summer patterns in the El Niño - Southern Oscillation (ENSO) cycle.

The results surprised me. I thought farms might do better if they have more to sell, with more bushels lowering their cost per bushel even if per bushel prices were lower. Turns out this assumption was wrong. Feel free to trot out that saying about assumptions, if you must.

Instead, the Monte Carlo analysis indicates that higher prices from lower yields triggered by La Niña would more than offset a higher per bushel production cost. Higher yields from El Nino or a neutral ENSO produced lower profits. This means average cash corn prices received by farmers were positively correlated with profits. That is, as prices go up, so do profits, and vice versa.

The opposite relationship exists between yields and profits – the correlation between the two is negative. Profits go up as the percentage of normal trend yields achieved goes down.

Profit in La Niña?

Don’t start kicking the tires on new equipment just yet. La Niña increases profit potential, but large leftover supplies of 2023 crop corn are a headwind tough to weather. Average profit per acre under this scenario was only $6.55. Better than a loss, but not enough to break out the champagne.

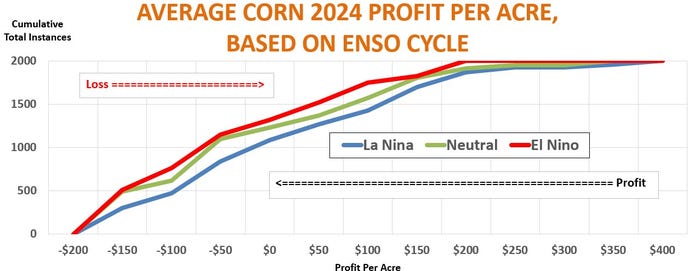

The chart below presents results of the Monte Carlo analysis under three alternatives. La Niña cooling is the blue line, El Niño warming in red, and the neutral ENSO cycle in green. This phase of the study looked at 2,000 scenarios for each, and the chart shows the cumulative total of profit per acre outcomes for the three. El Niño had more results with losses, so its line is on top as the total of these added up. La Niña had fewer of these and more with profits on the right side of the chart, so its line is on the bottom, with neutral ENSO sandwiched between.

Averages for the two other alternatives were losses, not the small profit resulting from La Niña. The average loss per acre for neutral was $23. The 2,000 El Niño alternatives averaged a loss of $43.

Factor in random impacts

As with any analysis, the devil is in the details – the assumptions (ouch!) I used. Correlations of results were enough to be statistically significant, but each alternative had years of gains and losses. Any of these could change depending on how the analysis model correctly matches the actual interplay between production, supply, demand and prices.

Demand, for example, generally varies with production, which is true for the major categories of usage. Ethanol plants grind more corn if there’s more of it around, as do livestock feeders and exporters. Prices account for some, but by no means all of this variance. Foreign buyers may not book lots of U.S. corn if they don’t need it, either because their own production is sufficient or when other sources cost less on a delivered basis. Politics, as we discovered during the trade war with China, can also play into this.

Predicting politics or production around the world is like forecasting prices. Nothing is a perfect one-to-one correlation. That’s why the spins of the Monte Carlo include factors for randomness. Some buyers may want a lot of U.S. corn even if it’s high-priced – if the United States is the only store in town.

The same randomness holds true for prices. On average, price is a function of supply versus demand, as represented by stocks-to-use ratios or number of days’ supply – except when it isn’t, such as when political winds blow or a black swan event, like a pandemic, Great Financial Crisis, or 9/11 attack, occurs. No one knows if the 2024 crop marketing year will see a return to normal, or yet another curve ball. So, the Monte Carlo must allow for this randomness as well.

One response to all this uncertainty is to just guess or play a hunch. As Dirty Harry asked: Do you feel lucky, punk?

Another response is the educated guess, which the Monte Carlo attempts. The key is to know how you’ll respond as the facts change here in the United States and around the world. Oh, and don’t bet all your chips on one spin.

About the Author(s)

You May Also Like