The significance of Brazil's corn and soybean production is a topic that deeply intrigues us and fuels ongoing debates.

Just six months ago, delays in soybean planting caused a spike in soybean prices, only for the market to retract as conditions improved. Such estimate fluctuations and discussions are a familiar sight among our southern neighbors. Yet, what's particularly fascinating now is the perspective offered by both the USDA and Conab.

Last week, both Conab and the USDA released their crop production reports simultaneously—Conab's in the morning and the USDA's in the early afternoon.

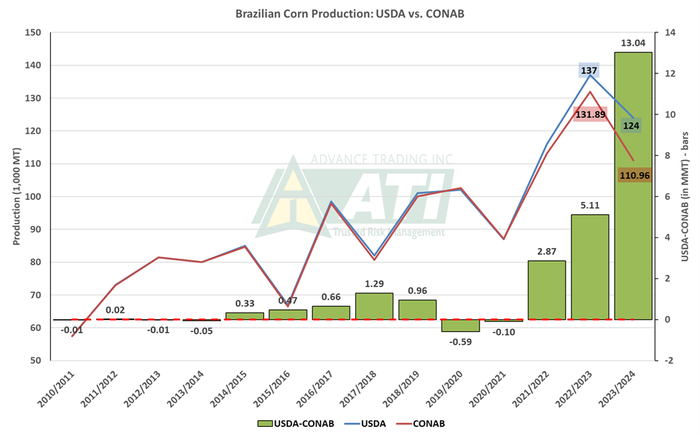

Conab revised down the total corn production, mainly due to a reduced yield from 5.535 MT/hectare to 5.444 MT/hectare, indicating a 1.7% decrease.

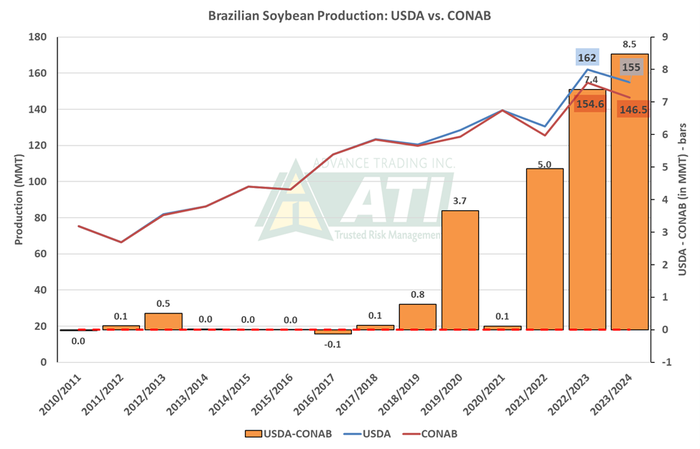

This adjustment led to corn production estimates of 110.96 MMT and soybeans at 146.52 MMT.

USDA upheld its prior estimates. A mere three hours after Conab’s report, USDA set corn and soybean production in Brazil at 124 MMT and 155 MMT, respectively.

This results in a discrepancy of 13.04 MMT for corn and 8.5 MMT for soybeans, equivalent to 513 million bushels and 299 million bushels, respectively. To provide context, North Dakota produced 543 million bushels of corn and 219 million bushels of soybeans.

Estimates diverge

Here's where the plot thickens. Historically, at least over the past 15 years, the USDA and Conab have been closely aligned in their estimates.

From 2010 to 2021, the largest observed difference was 1.29 MMT for corn and 3.7 MMT for soybeans. Interestingly, in four of those years, the discrepancy between the USDA and Conab was less than 0.05 MMT.

However, starting from 2021, this gap has gradually widened, culminating in the current substantial difference. What factors have contributed to this divergence? Given advancements in technology and reporting methodologies, one would expect estimates to converge rather than diverge.

Who is on point?

Now, the pressing question arises—whose estimate will ultimately prove to be more accurate? There's no guarantee of alignment between the estimates. The gap may persist throughout the year. If you're optimistic, you might lean towards Conab's figures, expecting a downward revision by the USDA in the months ahead.

Personally, I'm skeptical of Conab's recent reduction in corn yield, considering favorable planting conditions and lingering uncertainties about growing conditions. While the safrinha corn crop has yet to mature, I question whether a 1.7% yield reduction is justified at this stage.

Nevertheless, the market will diligently track this significant discrepancy in the months to come. Will Conab's estimates be vindicated? Or will the USDA's report stand as the more accurate portrayal?

Regardless of the outcome, the credibility of either report could face enduring scrutiny.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

BrazilAbout the Author(s)

You May Also Like