USDA’s first monthly production estimates released Aug. 12 provided a big surprise to a market badly needing some bullish news. But the prospect of below normal yields could also complicate growers’ storage decisions this fall.

As my annual strategies study showed, putting corn and soybeans in the bin last fall wasn’t the most profitable way to hold crops for the big rally. Strong basis and tight carries meant many producers were better off selling out of the field under a basis contract or buying futures outright.

Related: Grain storage lessons learned

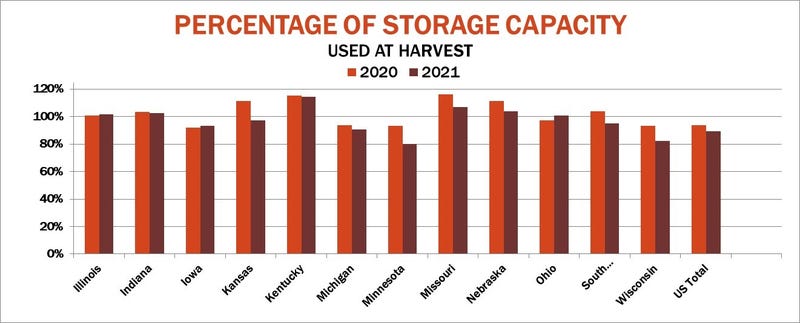

If average U.S. yields USDA reported last week are accurate, there should be plenty of room for fall harvests. Total corn and soybean production and 2020 leftover inventories combined with supplies of other major U.S. crops may fill only 89% of the nation’s grain storage capacity.

To be sure, some areas may still see grain piles, because conditions vary widely after another unusual growing season. Inventories in the Eastern Corn Belt appear likely to recover after a series of disappointing harvests. The opposite situation prevails to the north and west, where drought is slashing production.

New crop basis reflects this situation. In western Kansas fall corn is premium futures while soybean bids are nearly a dollar stronger than 2020. Eastern soybean basis hasn’t made a major move compared to a year ago, but corn bids there are 30 to 40 cents weaker at key terminals.

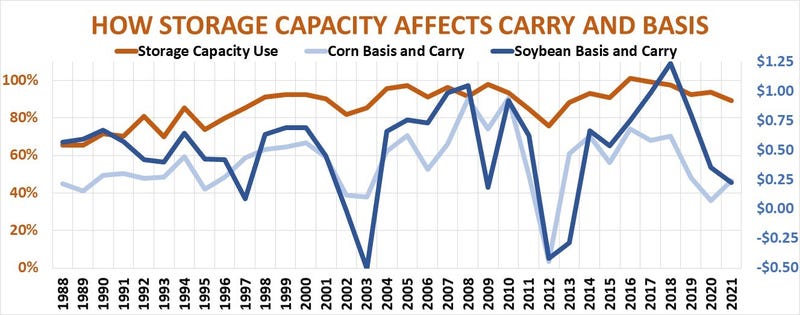

Harvest cash markets can be affected by whether or not local farmers have space for their crops, or are forced to sell out of the field. Basis varies widely from location to location due to other factors as well, including transportation costs. But carry, in this case the difference between harvest delivery and July 2022 futures, is the same regardless of where you farm. And spread traders, who include many commercial merchandisers, have definitely taken note of tightening supplies. The December 2021/July 2022 corn spread closed last week at just nine cents, while November 2021 traded at an 11-cent premium to July 2022 soybeans.

Clues to storage success

Factoring carry with cash market conditions provides clues about storage success. Large carry at harvest improves odds for hedgers who protect corn inventory by selling futures. But lack of significant basis appreciation may make futures more attractive than long-term on-farm storage for soybean growers.

Of course, new crop bids and carry could change as combines start rolling and more is known about yields. Though the combination of the two factors is smaller than normal, corn carry and basis are a little larger than last year while the soybean total is smaller.

It’s also important to remember that storage capacity is only one piece in the cash market puzzle. Capacity usage is responsible for 68% of the variance seen in potential basis appreciation for corn and 58% for soybeans. But other factors, notably weather and demand, could also affect carry and basis in 2021.

Sure, there was plenty of storage available last year on average due to disappointing yields. But the secret sauce was likely the surge in export demand that helped make harvest basis and carry the tightest since the 2012 drought year.

Export prospects for next year are mixed following what are expected to be record sales of 2020 crop corn and soybeans. USDA Aug. 12 lowered its forecast for 2021 exports of both corn and soybeans. New crop soybeans sales are down from a year ago as Chinese demand is expected to weaken. Preseason commitments have a good correlation with what is actually shipped because most of the business takes place in the first half of the marketing year ahead of the South American harvest.

New crop corn bookings so far easily are a record ahead of the start to the marketing year Sept. 1 as buyers look to replace supplies from Brazil cut by drought affecting that nation’s big second crop. But early U.S. sales show little correlation to final numbers, because the corn selling season typically lasts longer.

Weather could also be a wild card: A fast harvest could depress basis and widen carry to encourage corn to stay off the market, while a more spread-out season could avoid ground piles even in areas with good production. The National Weather Service updates its official long-term forecasts Aug. 19, but some models are already calling for above normal precipitation this fall due to a shift to the La Niña cycle that appears to be accelerating.

So while making yield checks in coming weeks to see how much you may harvest, don’t forget to monitor the other key factors that could also affect how you use your bins this fall.

Read more about:

Grain StorageAbout the Author(s)

You May Also Like