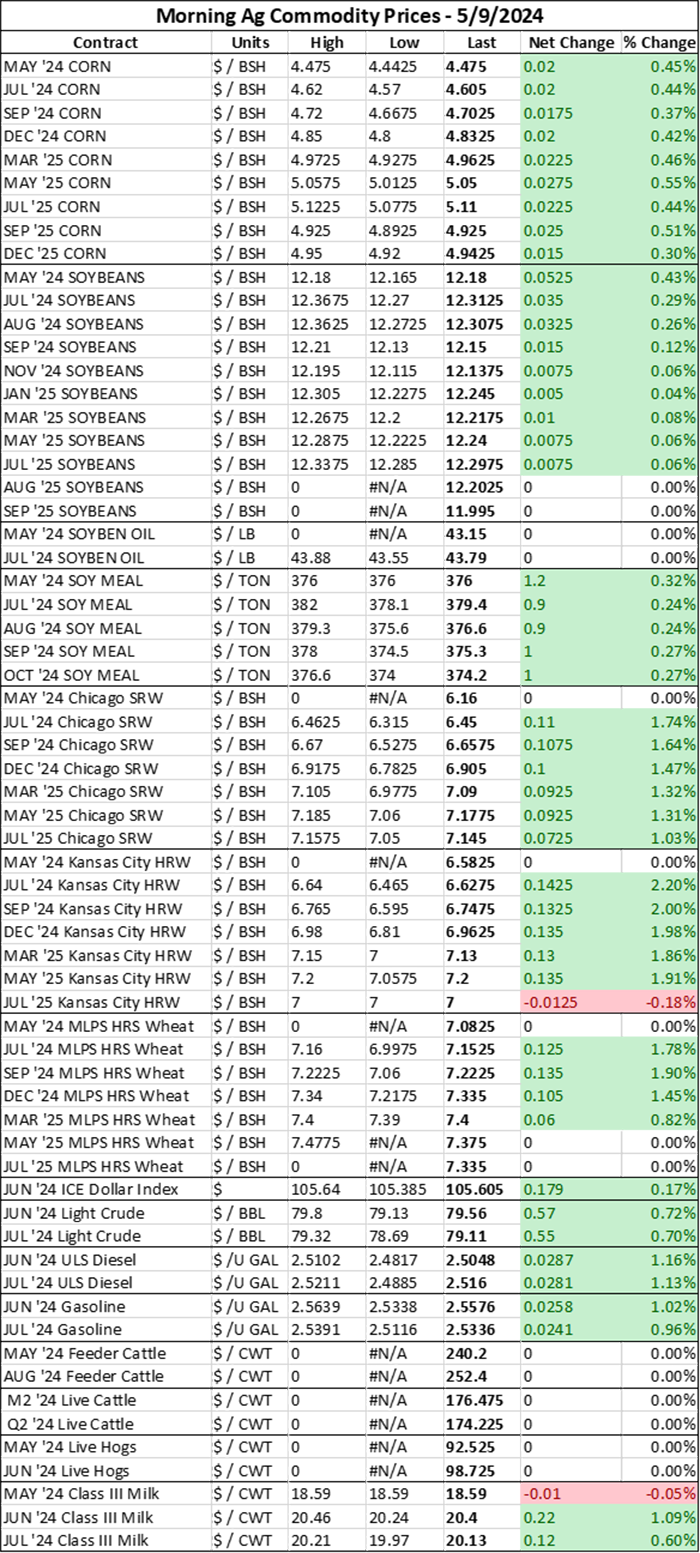

At a Glance

- Corn mixed to flat

- Soybeans down 3-5 cents; Soyoil down $0.18/lb; Soymeal down $1.20/ton

- Chicago SRW wheat up 9-11 cents; Kansas City HRW wheat up 15-16 cents; Minneapolis spring wheat up 12-13 cents

Don’t miss the latest market commentary from the Farm Futures team. Sign up for the complimentary morning and afternoon market newsletters!

Prices updated as of 6:55am CDT.

Good morning!

Yesterday was National Nurses’ Day and, in my haste to harass my policy editor colleague, Joshua Baethge, about his Dallas Stars’ playoff loss to my Colorado Avalanche, I forgot to send best wishes and appreciation to all of the wonderful nurses out there – particularly to my mom!

Mom has been a nurse for nearly 40 years and has shown us by example how caring for one another is one of the biggest strengths a person can possess. Nurses run this world and we are better off for it!

Also – the Avs and Stars square off again tonight in Dallas for game two of round two in the Stanley Cup playoffs. The puck – and Josh Baethge’s tears – will drop at 8:30pm CDT tonight on TNT or HBO (or Max…whatever we’re calling it these days)!

Aquifers and agriculture

The Wall Street Journal published an insightful video yesterday about aquifer depletion across the country that highlighted how growing water scarcity is a problem for long-term agricultural and societal success alike.

The video starts out by focusing on the Southern Plains – specifically Western Kansas – and the toll recent drought conditions are taking on ground water supplies and local economies. But as the video progresses, it also emphasizes that metropolitan water consumption is intertwined with declining yields as water tables fall.

It’s a great video for farmers and non-farmers alike. 10/10 recommend!

Crop updates

Corn planting still has a way to go on my family’s dairy farm in Northwestern Illinois, but another headache has presented itself that – believe it or not – takes precedence over corn planting.

Alfalfa weevils have been reported in fields across our county, though they aren’t a new springtime phenomenon for hay producers (check out this brilliant article from the Nebraska extension). For those who don’t know, alfalfa weevil eggs will overwinter on alfalfa plants and hatch in the spring if the winter was mild – like this past winter (thanks a lot, El Niño).

The larvae then proceed to eat the leaves of the alfalfa plants ahead of the first crop cutting in the spring. Essentially, the weevils strip the plants down to the stem, removing the primary nutritional value we need for dairy cattle feed.

Our farm is about 7-9 days away from chopping first crop alfalfa silage and while we haven’t spotted the weevils yet, a well-placed breeze could easily blow them in. Insecticides fully eliminate weevils, but it has a two-week residual and is about it reach its peak nutritional value in half that time.

We are truly racing the clock now. Many farms in the area are cutting alfalfa early to avoid maximum crop damage. But there is a tradeoff between cutting too early and risking losing out on critical crop nutrients for silage that we are trying to balance.

Gah. The joys of spring.

How is planting going on your farm? Are your alfalfa fields fighting off weevil pressures? Share your insights with us in our ongoing Feedback from the Field survey!

Feedback from the Field is an open-sourced, ongoing farmer survey of current crop and weather conditions across the Heartland. If you would like to participate at any time throughout the growing season, click this link to take the survey and share updates about your farm’s spring progress. I review and upload results daily to the FFTF Google™ MyMap, so farmers can see others’ responses from across the country – or even across the county!

Fertilizers

First quarter earnings season is wrapping up on Wall Street. Yesterday’s batch of reports featured insights from the world’s largest fertilizer producer, Nutrien.

The Canadian-headquartered company saw a 1% uptick in share price afterhours yesterday as early planting intentions in the Northern Hemisphere and a tightened grip on inventory helped Nutrien to outperform its first-quarter earnings estimates.

The warmer winter (once again, thanks El Niño) and excess farmer cash from the last three years of top-11 ranked U.S. net farm incomes helped prop up first quarter earnings for Nutrien as farmers continued a buying spree in hopes of planting early as winter ended. First quarter fertilizer sales volumes in North America were nearly 23% higher than the same time a year prior.

Lower natural gas costs and an uptick in farmer demand for nutrients after several years of volatility have Nutrien poised to keep the anhydrous ammonia market well-stocked – for now. But declining selling prices of those nutrients has Nutrien in a tricky position.

Nutrien’s profit margins on its earnings from fertilizer production have increased over the past year, though the value of those total sales has decreased during that time. Larger volumes of product shipped offset the lower prices, but this finding suggests that Nutrien will be very deliberate in the volumes it adds – or decreases – in its summer restock period. That tells me that fertilizer prices – which have been largely unchanged in recent weeks – are likely to remain at current levels for now and that fertilizer producers may opt to restrict summer restock production to maintain supply control.

That means more “scheduled downtime for plant maintenance” this summer and less production that could push up fall fertilizer prices for farmers. It will also depend heavily on what corn prices do, so if Brazil’s safrinha corn crop can make it through its peak pollination period over the next couple weeks unscathed, then we could see lower corn prices, which would help keep a ceiling over fertilizer costs as well.

And here was my favorite tea spilled in yesterday’s earnings call!!

Nutrien’s South American division continues to bleed the rest of the company’s profits dry as supply chain volatility from Russian’s 2022 invasion of Ukraine continues to cause ripples in the South American fertilizer market. It’s worth noting ��– profit margins for North American growers have been more stable (and more lucrative) than their South American counterparts, who have been battling higher input prices and lower crop revenues before U.S. growers encountered those issues earlier this year.

And with at least eight members of Nutrien’s South American leadership team departing over the past year, it seems likely that the company may be looking to divest its Latin American arm in favor of focusing on North American sales.

Interesting!

Corn

Corn markets wavered within a penny of gains and losses in the early morning hours, with nearby Jul24 futures last trading at $4.58/bushel and new crop Dec24 prices settling at 4.81/bushel.

It was a quiet night in the corn market as markets brace for tomorrow’s WASDE report. Corn prices struggled to reconcile large 2023/24 U.S. ending stocks against Argentine crop damage and spillover strength from the wheat market this morning.

Soybeans

Soybean futures drifted $0.03-$0.46/bushel lower this morning, sending most actively traded Jul24 contracts to $12.2425/bushel and new crop Nov24 futures to $12.085/bushel during the overnight trading session.

Losses during Wednesday’s trading session spilled over into the early morning trading hours. China continues to snap up cheap Brazilian soybean supplies in April, helping to limit soybean’s losses this morning.

Markets are also bracing for an uptick in domestic 2024/25 ending stocks as farmers are expected to plant more soybean acres in the U.S. this spring.

Wheat

Wheat prices rallied $0.09-$0.13/bushel higher this morning after Russia’s state news agency, TASS, reported that frost damage over the past week has damaged wheat plants during peak grain-fill stages.

Russia is the world’s largest wheat exporter. A warm winter accelerated the speeds at which its winter wheat crop emerged from dormancy. Dry weather has also stressed Russian winter wheat crops and left it more susceptible to May frost damage.

Local Russian governments declared states of emergency in the country’s three largest wheat-producing states yesterday. The recent weather snafus will likely limit the 2024 wheat harvest, though the ministry of agriculture is committed to helping farmers to replant.

My latest E-corn-omics column dives into the negative weather impacts on Russia’s winter wheat crop and how other weather disturbances across the Northern Hemisphere this spring could take a toll on global wheat export supplies.

As recently as Monday, wheat prices have soared to nine-month highs on the news. For farmers tracking heading development on winter wheat crops and planting spring wheat progress in the U.S., this rally might be a lucrative chance for farmers to make profitable 2024 marketing decisions.

Weather

The rest of this week might be rainy, but clear skies are finally back in the forecast by the end of the week. It will be narrow window, however, according to the National Weather Service’s short-term forecasts.

Skies will mostly clear across the Heartland early Friday morning, though some residual showers in the Northern Lake States and Eastern Corn Belt will pass through. Showers could linger in the Eastern Corn Belt on Saturday, but skies are expected to remain clear elsewhere across the Corn Belt into the evening.

At that point, the High and Southern Plains could see showers as rain clears out of the Eastern Corn Belt on Saturday night. Sunday will start out clear for the Heartland, but widespread showers are expected for most of the Corn Belt by Sunday afternoon.

If there is a silver lining to be had, it is that temperatures are going to remain warm throughout the extended forecast, which should help dry up wet fields when the skies do clear. NOAA’s 6-10-day outlook predicts above average chances for warm temperatures throughout the middle of next week, with the Upper Midwest enjoying the highest probability of warmth.

Moisture outlooks during the middle to end of next week continue to trend higher than average for key corn and soybean producing states in the U.S., with the Southern Plains receiving the highest chances for showers. Skies will remain dry in the Pacific Northwest during that time.

Looking to next weekend, widespread warmth will continue to dominate the temperature outlook, according to NOAA’s 8-14-day forecast. Moisture probabilities in the Upper Midwest will revert to seasonal averages, with the Southern Plains and Southern Corn Belt forecasted to receive highest chances for moisture during that time.

It’s been a rough start for some, and it seems highly likely that farmers will continue to dodge rain drops over the next week or so. But nevertheless, farmers are plowing through spring fieldwork as quickly as possible.

Financials

S&P 500 futures edged 0.15% lower this morning to $5,204.75.

What else I’m reading at www.FarmFutures.com this morning:

Naomi Blohm examines if we’ve hit the “spring low” for corn prices.

My latest E-corn-omics column takes a quick look at major market factors for corn, soybean, wheat, and fertilizer markets.

Policy editor Josh Baethge summarizes the Biden administration’s new sustainable aviation fuel standards and shares some of the challenges farmers may face with the program.

Analyst emeritus Bryce Knorr is watching these four marketing items as peak planting season ramps up.

Just like in the NFL draft last week, AgMarket.Net hedging strategist Tyler Schau recommends farmers stick to their strategy when it comes to grain marketing plans.

About the Author(s)

You May Also Like