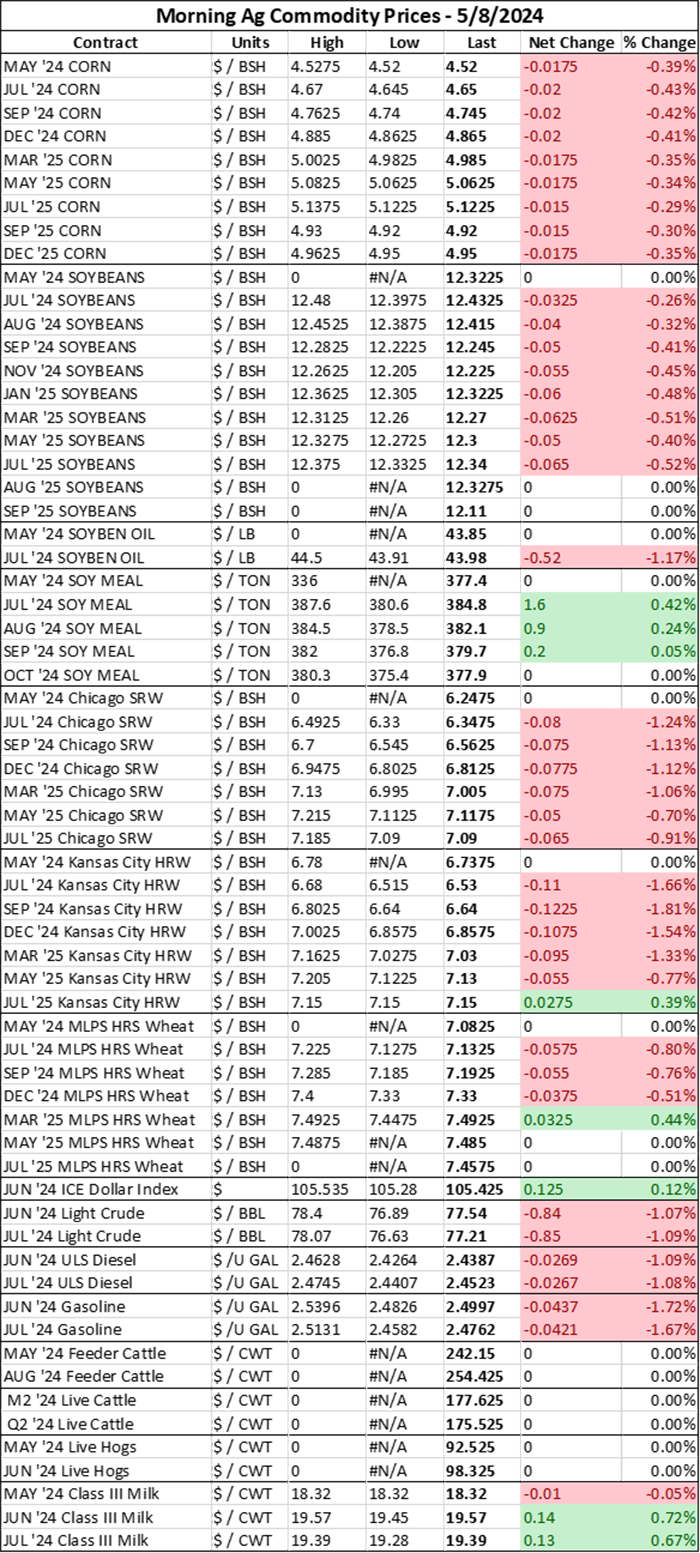

At a Glance

- Corn down 1-2 cents

- Soybeans down 3-6 cents; Soyoil down $0.50/lb; Soymeal up $1.40/ton

- Chicago SRW wheat down 7-8 cents; Kansas City HRW wheat down 11-12 cents; Minneapolis spring wheat down 7-8 cents

Don’t miss the latest market commentary from the Farm Futures team. Sign up for the complimentary morning and afternoon market newsletters!

Prices updated as of 6:55am CDT.

Good morning, Dallas!

The Colorado Avalanche beat the Dallas Stars in overtime last night, so our household has been celebrating in the early morning hours (we go to bed too early to watch an 8pm Mountain time game)!

Policy editor Joshua Baethge is joining us this morning to share his thoughts on the game:

I was already celebrating when the Stars went into the first intermission up 3-0. It was one of the best 20 minutes I’ve ever seen them play.

To put 3-0 into perspective for non-hockey fans, that’s like a four-touchdown lead going into halftime. The game technically isn’t over, but it probably is. I thought I might even get to bed at a decent time. Instead, I stayed up to witness a choke job for the ages.

Maybe the Avs are a little good too.

As you may have seen yesterday, my colleague Jacquie can talk a good game. However, as any expert grain market analyst knows, it takes more than one minor event to change a long-term trend. The Stars remain the best team in the Western Conference.

Speaking of trends, Dallas also spotted Vegas two games in the last round before storming back to take the series. It’s all part of our plan. I think.

Thursday’s game can’t come soon enough!

Planting updates

My family’s farm in Northwestern Illinois was able to seed oats and alfalfa last week. And forget about the silage corn we need for our dairy cows – the sweet corn patch was the first field to be checked off the list for corn planting! My dad and the grandkids are all thrilled because harvesting the sweet corn patch is everyone’s favorite summer activity (well, mostly everyone)!

My brothers and Mom – less impressed. But my brothers, brother-in-law, and dad have been working around the clock to keep that planter rolling in between rain showers and milkings. I missed Dad’s call last night to hear yesterday’s updates (though I did get text messages about Chris’s Denver Nuggets’ lackluster playoff performance against the Minnesota Timberwolves), but through Sunday evening it sounded like they were a third of the way done.

How is planting going on your farm? Share your insights with us in our ongoing Feedback from the Field survey!

Feedback from the Field is an open-sourced, ongoing farmer survey of current crop and weather conditions across the Heartland. If you would like to participate at any time throughout the growing season, click this link to take the survey and share updates about your farm’s spring progress. I review and upload results daily to the FFTF Google™ MyMap, so farmers can see others’ responses from across the country – or even across the county!

Corn

After a couple days of weather-fueled rallies in the ag markets, we are back to boring market updates this morning. Ag markets continue to await Friday’s WASDE reports from USDA, which should provide a revival in new crop price activity following its release.

In the meantime, corn futures are trading $0.01-$0.02/bushel lower this morning. Jul24 futures have dipped to $4.65/bushel while new crop Dec24 futures are trading at $4.865/bushel at last glance.

“Corn is again following moves in wheat, as has been happening recently," StoneX commodity risk manager Matt Ammermann told Reuters. "Corn is also seeing some downward pressure on expectations that the rate of U.S. plantings will accelerate.”

Good planting weather is forecasted for the Heartland this weekend, which should help farmers surge closer to that critical completion mark ahead of mid-May, when analysts begin to really worry about the optimal yield window for corn planting.

Soybeans

Soybean futures drifted $0.03-$0.06/bushel lower this morning, sending most actively traded Jul24 contracts to $12.4275/bushel and new crop Nov24 futures to $12.22/bushel during the overnight trading session.

“Soybeans are also seeing selling pressure after their strong rises. China also seems to be concentrating its purchases on Brazilian supplies, with the flood problem likely to be a temporary issue. There is talk China has bought around 22 shipments of Brazilian soybeans for May/June shipment, depressing demand for U.S. beans,” Ammermann told Reuters.

“Soybeans, wheat and corn are also facing weakness because of general expectations the USDA will give a picture of plentiful world supplies in its report on Friday.”

The Brazilian trade organization for grain exporters, Anec, told reporters yesterday that the recent flooding in Southern Brazil has halted grain shipments and damaged cooler facilities necessary for meat processing and storage in the region.

Trucks caring corn and soybean cargoes throughout Rio Grande do Sul are being forced to take detours nearing up to 250 miles to avoid the flooding. Some grain silo damage has also been reported from the flooding, but farmers expected the damage to be minimal.

More concerning to growers is the crops remaining in the flooded fields still awaiting harvest. Brazil’s Rio Grande do Sul typically grows about 14% of Brazil’s total soybean and 5% of its corn (first crop) harvest. When the rains hit last week, ag consultancies expected 34% of Brazil’s soybeans remained unharvested, while most of the corn (somewhere in the upper 80th percentile) had been harvested by that point.

That means somewhere around 5% of Brazil’s 2023/24 soybean crop is now in jeopardy of disappearing from the global soybean balance sheet ahead of Friday’s WASDE reports from USDA. USDA currently forecasts the Brazilian soybean crop at 5.695 billion bushels (155 MMT).

Analysts had already suspected that USDA could go lower on that estimate following last month’s WASDE, based on yield variability in Mato Grosso and a USDA attaché report published in March that forecasted 5.607 billion bushels (152.6 MMT) of 2023/24 soybean production.

My redneck math estimates aren’t great, but I suspect we could see USDA drop its Brazilian soybean production estimate to or slightly below the 5.511-billion-bushel (150 MMT) benchmark in Friday’s report. That means nearly 200 million bushels of soybeans could be erased from 2023/24 global soybean balance sheets, which might provide farmers with some profit opportunities for old crop supplies later this summer.

Wheat

Wheat prices once again took a hit from a stronger dollar overnight, falling $0.06-$0.12/bushel as additional rains expected in the U.S. Southern Plains and in Southern Russia offered a lifeline to drought-stressed winter wheat crops currently in peak grain fill stages.

“Wheat is being weakened partly by forecasts today of some rain in the dry south Russian grain regions and also in parts of the U.S. hard red winter regions, which would be welcome in both areas,” Ammermann told Reuters. “There is some selling pressure following the highs hit on Wednesday by wheat.”

My latest E-corn-omics column dives into the negative weather impacts on Russia’s winter wheat crop and how other weather disturbances across the Northern Hemisphere this spring could take a toll on global wheat export supplies.

As recently as Monday, wheat prices have soared to nine-month highs on the news. For farmers tracking heading development on winter wheat crops and planting spring wheat progress in the U.S., this rally might be a lucrative chance for farmers to make profitable 2024 marketing decisions.

Weather

Yesterday’s showers will move a little further south of the Canadian border, but will still continue to linger in the Upper Midwest and Eastern Corn Belt today, according to NOAA’s short-range forecasts.

Severe thunderstorms will also shift south, centering over the Missouri, Mississippi, and Ohio River confluences as well as into the Southeast. Even in regions where rain is expected today, warm temperatures should help the soil to keep soaking up the excess moisture.

Shower totals are expected to range between a quarter and a half inch across most of the Heartland areas impacted by showers today, although Upper Iowa, Southeast Missouri, Southern Illinois, Kentucky, and Tennessee could see over an inch of accumulation in the next 24 hours – a total that increases to closer to two inches further south.

Friday morning should FINALLY bring some widespread clear skies to the Heartland, so make sure your planting rigs are ready to go at the end of next week. And make sure you book all of your Mother’s Day gifts ahead of this weekend because there is a good chance you’re going to miss her day because you’re in the fields. You should also spend a little extra on that gift while you’re at it – Mom is worth it!

Temperatures will continue to run above average early next week, according to NOAA's 6-10-day outlook, but only for the area west of the Mississippi River. At that time, temperatures will trend below average for the Southern Plains and Southeast. Chances for showers will finally revert to average levels for most of the Heartland, with dryness expected to pop up in the Pacific Northwest into the Dakotas. The High Plains will enjoy above average chances for rain during that time.

Warm temperatures will push further east by the middle of next week in NOAA’s 8-14-day forecast. During that time, the Plains will see the highest chances for warmer temperatures. Moisture forecasts are once again projecting an above average chance for widespread showers across the Heartland during that time.

That means that this weekend through early next week might be the best chances U.S. farmers have for making rapid planting progress as the middle of May approaches.

Financials

S&P 500 futures edged 0.15% lower this morning to $5,205.25, likely lower on a round of profit-taking as first quarter earnings season comes to a close. Dow futures have recorded five consecutive days of gains on favorable earnings reports as of Tuesday afternoon. Markets are increasingly watching job statistics for signs that the economy may be constricting in hopes the Federal Reserve will lower interest rates in the coming months.

What else I’m reading at www.FarmFutures.com this morning:

Naomi Blohm examines if we’ve hit the “spring low” for corn prices.

My latest E-corn-omics column takes a quick look at major market factors for corn, soybean, wheat, and fertilizer markets.

Policy editor Josh Baethge summarizes the Biden administration’s new sustainable aviation fuel standards and shares some of the challenges farmers may face with the program.

Analyst emeritus Bryce Knorr is watching these four marketing items as peak planting season ramps up.

Just like in the NFL draft last week, AgMarket.Net hedging strategist Tyler Schau recommends farmers stick to their strategy when it comes to grain marketing plans.

About the Author(s)

You May Also Like