“Sell in May and go away” is a battle-worn adage on Wall Street that gained traction last week as stock prices posted new all-time highs. This seasonal trend could also be useful closer to Main Street.

Of course, most farmers can’t simply sell their corn and soybeans and head to the Hamptons for the summer. But taking advantage of late spring rallies to price some remaining old crop inventory as well as production expected this fall is one way to manage risk in case markets sputter in the months ahead.

Sure, average prices tend to peak in June or July, just when a threatening La Nina weather pattern is expected to develop in 2024. But at least a third of the time – sometimes more often – May rallies are as good as it gets.

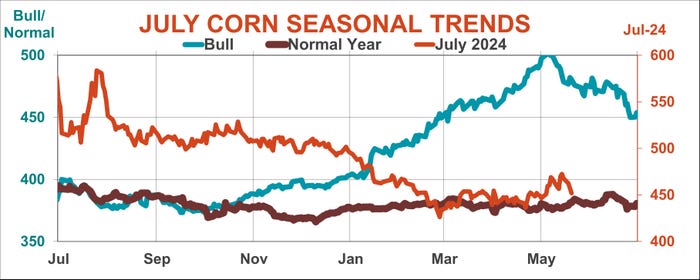

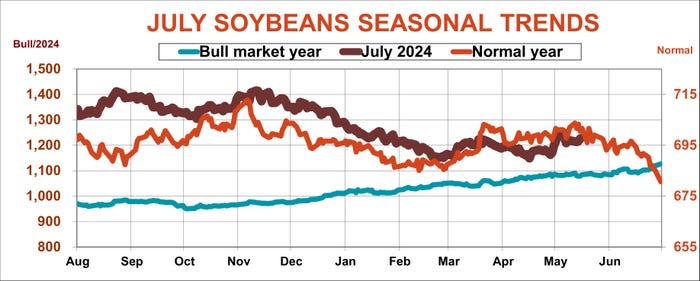

Time may be running out, especially for old crop. July corn futures tend to fall off after May 40% of the time, while May is as good as it gets for July soybeans more than one of every two years.

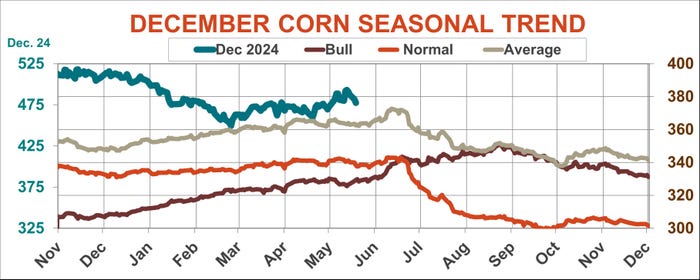

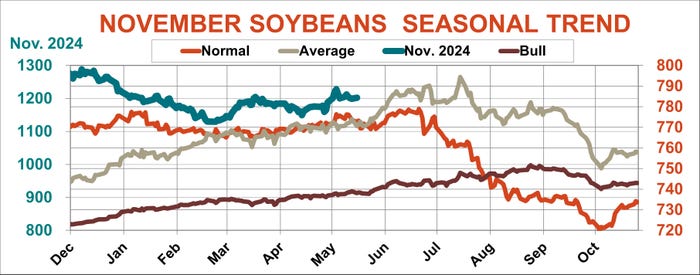

New crop prices also face risk, one reason Farm Futures long-term study of sell strategies found three windows where pre-harvest hedging pays off:

the second week of April and mid-May for both crops

late June corn sales

mid-July soybean hedges

Corn and soybean turn lose of rallies

Right on cue, corn and soybean futures wobbled last week after gains earlier in May. Both appeared to lose grip on coattails ridden to rallies.

Corn gave back gains after getting a push from three factors:

Slower than normal planting progress

How fast – or slowly – farmers plant corn is an issue every year, and impacts both old and new crop prices.

Old crop can benefit if farmers are too busy in the field to move inventory to town, forcing end users to bid up local cash prices or buy July futures as a surrogate. So, even though futures on average peak in the last week of June before delivery, prices slumped in June more than 40% of the time over the past 50 years.

Planting speed has a more direct impact on December futures. Mid-May planting progress is a key variable in USDA’s methodology for the agency’s statistically produced “normal” trend yield used to forecast supply until surveys of farmers and their fields in August. With May 15 in the record books for 2024, somewhat below average speed could trim expected yields a little from the 181 bushel per acre figure USDA has used for this year since last fall. Still, conditions in June and July are far more important in determining final yields.

A friendly May 10 USDA report

World Agricultural Supply and Demand Estimates can impact markets every month and the May print was no exception. In addition to updating old crop numbers, the May report featured the agency’s first monthly forecast for new crop.

Usually this is merely a reminder that supplies will be adequate unless growing-season weather intervenes, plenty of reason for the market to pull back.

This year’s edition put projected supplies left over at the end of the upcoming marketing year Aug. 31, 2025, at 2.1 billion bushels, hardly a bullish number. But it was less than the trade expected in part thanks to a bullish twist. USDA cut its estimate of projected 2023-2024 carryout by 100 million bushels, more than expected, and that reduction carried over to 2024-2025. Both old and new crop futures got a boost for a day or so as a result.

Wheat surged to its best level since harvest last summer

Nearby Chicago flirted with $7 before retreating, giving a lift to corn. USDA’s wheat numbers were slightly bullish, with production and projected carryout less than expected. But the real news came from overseas, where weather and war stressed crops from Russia to Ukraine and Europe. USDA projected world stocks would fall to the lowest level since 2015-2016, when futures ground lower on their way to a test of just $4 before making long-term lows.

That rekindled nascent hopes wheat could be due for another run after a stunning 60% fall from 2022 post-pandemic highs, taking corn higher too.

Wheat and corn can be complicated dance partners. Cheap coarse grains encourage less wheat feeding and vice versa, but sometimes what’s good for the goose is good for the gander, too.

Soybean spirits

Beans found buoyance by ignoring seemingly bearish numbers from USDA. After a little initial turbulence, traders focused on news that was more friendly, stabilizing futures 25 to 30 cents below highs from earlier in May after a selloff that anticipated forecasts for increasing supplies.

The WASDE kept old crop carryout steady at 340 million bushels and increased the bottom line for 2024-2025 to 445 million, the most since the start of the trade war. China was again on the mind of the market, the elephant in the room as tensions with the U.S. swayed back-and-forth like a tennis match. A few green shoots appeared in economic news of out China, long a bearish factor as growth there slowed in the wake of botched pandemic solutions and new measures that seemed to go nowhere too. But a pickup in the Chinese stock market after a drop of nearly 50% from 2021 highs was a strong enough technical signal to create FOMOR – fear of missing out on a rally – taking the CSI Index to its best level of 2024.

China’s soybean imports still aren’t expected to grow, despite the better economic hopes, thanks to an aging population and low birth rate. Whether the U.S. share of that business improves depends on competition from Brazil, where leaders continue to court Chinese investment in return for an improved political alliance.

Brazil can’t sell what it doesn’t have, keeping late season rains inundating the country in the news though damage to overall production was difficult to assess.

Bets on a biodiesel boom that would continue to increase crush were just as murky thanks to U.S. politics, where subsidies and mandates might run into headwinds. New U.S. tariffs could also trigger a Beijing backlash, though their impact appeared mostly rhetoric, not reality.

U.S. planting progress was also a double-edged sword. Severe delays with corn past prevent plant crop insurance deadlines could encourage a switch to soybeans unless weather also disrupts soybean seedings. But these milestones are still a ways in the future, and don’t seem likely to be much of a factor this year.

Old crop soybean inventory appears most at risk, though July futures on average peak in June. A few big rallies distort those averages – futures fall off in June into delivery once every two years, a threat for producers who can’t withstand a downdraft. And, though new crop rallies can be explosive, May is as good as it gets for November futures nearly 60% of the time.

Dollar dithering

Both corn and soybeans also ran into headwinds from one part of Wall Street, where the ongoing soap opera about interest rates was center stage. News about inflation and growth provided mixed signals, sometimes on the same day, leaving hopes for a rate cut and a weaker dollar uncertain at best.

The greenback overall was weaker, reflecting bets on Federal Funds Futures, with increased odds for two or even three cuts in 2024. Such aggressive action from the Fed may be too much to ask for, requiring the central bank to ignore howls of playing politics with monetary policy that would surely follow.

The Fed’s next scheduled meeting is June 11-12. A move so early still seems unlikely, unless pressure from allies squeezed by weakness against the dollar convinces U.S. officials the threat to derail the global economic recovery is too great to ignore.

The value of the dollar doesn’t affect U.S. corn and soybean exports directly by raising or lowering prices. But it can change our customers’ purchasing power and overall economic well-being, which can be factors.

So, like everything else this spring, lack of clear-cut signals makes unpredictable markets even harder to predict. Kinda’ like the weather!

About the Author(s)

You May Also Like