At a Glance

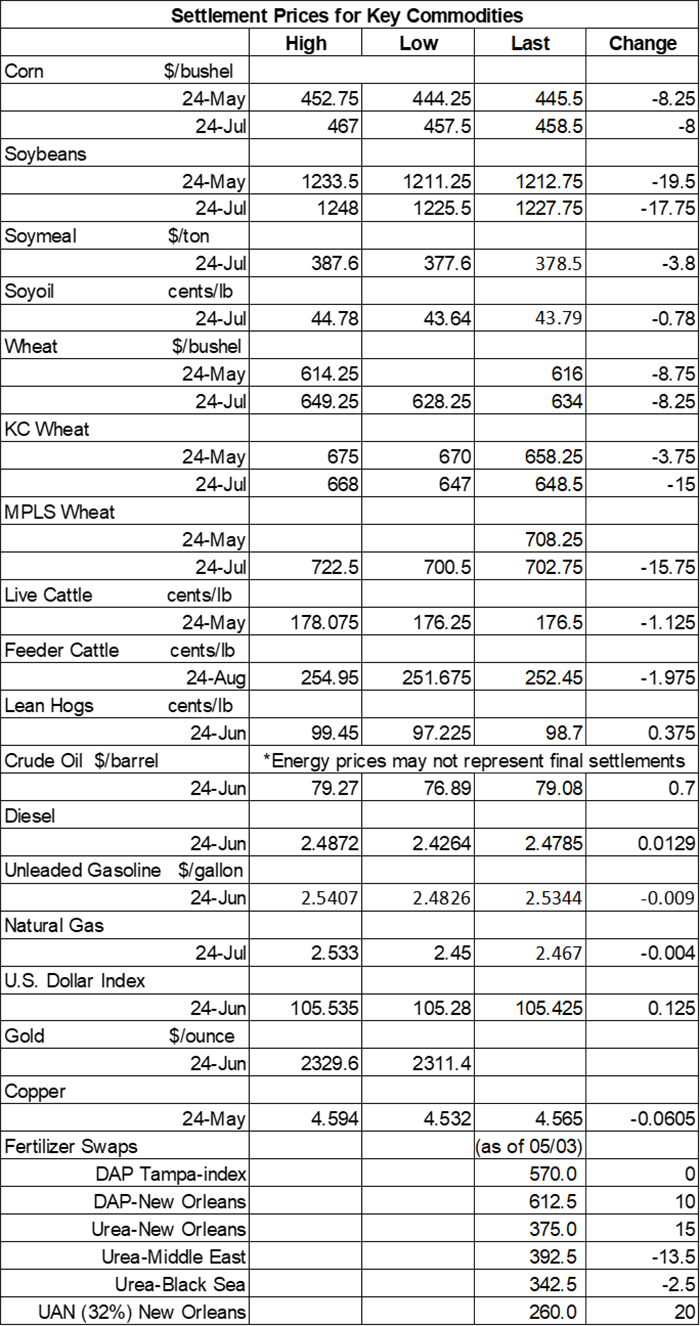

- Corn and soybean prices each stumbled 1.5% to 1.75% lower

- Wheat prices faced variable losses, with some contracts down more than 2%

- Plus: Ethanol production failed to meet a key benchmark for the fourth consecutive week

Don’t miss the latest market commentary from the Farm Futures team. Sign up for the complimentary morning and afternoon market newsletters!

Grain prices were back in the red on Wednesday following a round of technical selling that dragged down a broad set of commodities as traders continue to square positions ahead of Friday morning’s World Agricultural Supply and Demand Estimates (WASDE) report from USDA. Corn and soybean prices each faced sizable drops, while some wheat contracts eroded more than 2% lower.

At least some measurable rainfall is likely for most areas east of the Mississippi River between Thursday and Sunday, with some fields likely to gather as much as 1.5” or more later this week, per the latest 72-hour cumulative precipitation map from NOAA. Later on, NOAA’s new 8-to-14-day outlook predicts seasonally warm, wet weather for most of the central U.S. between May 15 and May 21.

On Wall St, the Dow trended 161 points higher in afternoon trading to 39,045, with a good chance to extend its current winning streak to six days. Energy futures were mixed, with crude oil up 0.75% this afternoon and nearing $79 per barrel. Diesel was up around 0.4%, while gasoline slid 0.4% lower. The U.S. Dollar firmed slightly.

On Tuesday, commodity funds were net buyers of soyoil (+2,000) contracts but were net sellers of corn (-1,000), soybeans (-2,000), soymeal (-2,000) and CBOT wheat (-2,500).

Corn

Corn prices suffered a moderate technical setback as traders continue to prep for Friday morning’s WASDE report. May futures stumbled 8.25 cents to $4.4550, with July futures down 8 cents to $4.59.

Corn basis bids were steady to mixed across the central U.S. after inching a penny higher at an Ohio elevator while sliding 2 cents lower at three other Midwestern locations on Wednesday.

Ethanol production faded slightly lower to a daily average of 965,000 barrels in the week through May 3, per the latest data from the U.S. Energy Information Administration, out Wednesday morning. That was also the fourth consecutive week that production failed to meet the 1-million-barrel-per-day benchmark. Ethanol stocks declined 5% last week.

Ahead of tomorrow morning’s export report from USDA, analysts expect the agency to show corn sales ranging between 23.6 million and 49.2 million bushels in the week through May 2.

Prior to Friday morning’s WASDE report from USDA, analysts expect the agency to show 2024/25 corn ending stocks at 2.284 billion bushels. Individual trade guesses ranged between 2.032 billion and 2.513 billion bushels.

Grain traveling the nation’s railways saw another 21,725 carloads on the move last week. That brings 2024 cumulative totals up to 369,758 carloads, which is 1.1% above last year’s pace so far.

Brazil’s Anec estimates that the country’s corn exports will reach 21.6 million bushels in May, which would be a year-over-year increase of 11.1%, if realized.

Taiwan purchased 2.6 million bushels of animal feed corn, likely sourced from Brazil, in an international tender that closed earlier today. The grain is for shipment starting in early July.

Corn settlements on Tuesday were for 390,700 contracts.

Soybeans

Soybean prices stumbled 1.5% to 1.75% lower on Wednesday following an ample round of technical selling that led to double-digit losses. May futures eroded 19.5 cents lower to $12.1275, with July futures down 17.75 cents to $12.2875.

The rest of the soy complex was also in the red. July soymeal futures faded 1% lower, with July soyoil futures tumbling 1.75% lower.

Soybean basis bids were steady to mixed after trending as much as 6 cents higher at an Illinois processor and as much as 5 cents lower at an Indiana processor on Wednesday.

Prior to Thursday morning’s export report from USDA, analysts expect to see soybean sales ranging between 9.2 million and 25.7 million bushels for the week ending May 2. Analysts also think USDA will show soymeal sales ranging between 100,000 and 400,000 metric tons, plus up to 12,000 MT of soyoil sales.

Ahead of Friday morning’s WASDE report from USDA, analysts expect the agency to show 2024/25 soybean ending stocks at 431 million bushels. Individual trade guesses ranged between 315 million and 552 million bushels.

As another crop season kicks off, Farm Futures grain market analyst Jacqueline Holland is assembling a new batch of Feedback from the Field updates, which is populated with farmer comments from around the Heartland. Click this link to take the survey and share updates about your farm’s spring progress. Holland reviews and uploads results daily to the FFTF Google MyMap, so farmers can see others’ responses from across the country.

Brazil’s Anec estimates that the country’s soybean exports will reach 485.4 million bushels in May, which would be a year-over-year decrease of 8.5%, if realized. Anec also expects to see Brazilian soymeal exports reach 2.34 million metric tons this month, versus 2.28 MMT last May.

Soybean settlements on Tuesday were for 334,564 contracts.

Wheat

Wheat prices followed a broad set of other commodities lower on Wednesday as traders shrugged off more weather woes in Russia, which has battled both drought and recent yield-damaging frosts. July Chicago SRW futures dropped 8.25 cents to $6.3450, July Kansas City HRW futures fell 15 cents to $6.49, and July MGEX spring wheat futures lost 15.75 cents to $7.0325.

Ahead of tomorrow morning’s export report from USDA, analysts expect to see wheat sales ranging between 3.7 million and 25.7 million bushels for the week ending May 2.

Prior to Friday morning’s WASDE report from USDA, analysts think the agency will show 2024/25 wheat ending stocks at 786 million bushels. Individual trade guesses ranged between 705 million and 879 million bushels.

Frost hitting two major Russian wheat production areas has led to “catastrophic consequences,” according to governor Igor Artamonov. “We must understand that this year’s harvest will be much smaller than the previous one,” he added. Russia is the world’s No. 1 wheat exporter.

Jordan issued an international tender to purchase 4.4 million bushels of milling wheat from optional origins that closes on May 14.

Japan hopes to purchase up to 2.4 million bushels of feed wheat and up to 1.1 million bushels of feed barley in a simultaneous buy-and-sell auction that will be held on May 15. Any grain that is purchased is for arrival by the end of October.

CBOT wheat settlements on Tuesday were for 143,658 contracts.

About the Author(s)

You May Also Like