Several years ago, Blake Hurst rented a farm that had a reputation and it was not a good one. Neighbors considered it a poor performing farm in the county.

"It had a lot of erosion, "Hurst says, "a lot of damage from years of neglect." Then three years ago, the Hurst family set out to improve the productivity of the farmland and it required a little help from citizens of the state of Missouri.

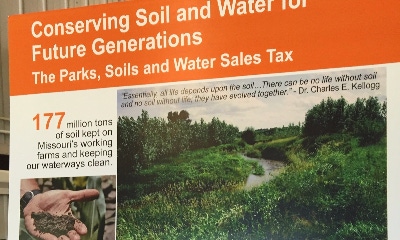

UP AGAIN: The Missouri Parks, Soils and Water Tax is up for renewal. Every 10 years, voters can approve a one-tenth-cent sales tax to benefit state parks and farmland. It will be on the Nov. 8 ballot.

Since 1984, Missouri's Parks, Soils and Water Sales Tax provided for both soil and water conservation efforts as well as operation of the state park system. The one-tenth-cent sales tax generates about $90 million annually, which is equally distributed to the Soil and Water Tax Fund and the State Park Sales Tax Fund.

Hurst's soil conservation practices were part of the 220,000 practices installed in the state of Missouri in the last 30 years. Through cost-share initiatives, he installed terraces and incorporated no-till farming practices to improve the productivity of the land. Today, the once ragtag farm is now garnering 15% more in yield.

The changes at the farm gained some attention. "A neighbor drove by our farm and said, 'You guys have made a real difference. I could never believe that farm could be that productive,'" Hurst shares. "That is what this program does thousands of times all across the state."

Statewide changes

It took the Dust Bowl of the 1930s to bring attention to soil erosion in the U.S. During a nine-year span, an estimated 300 million tons of soils was relocated across the nation, according to the Nature Conservancy. Missouri, like other states, struggled to keep its soils within its borders.

PIONEERS IN PROGRESS: Missouri Farm Bureau Public Affairs Director Estil Fretwell (left) was part of the state legislature that proposed the Parks, Soils and Water tax some 30 years ago. Over the years, MFB President Blake Hurst (right) used proceeds from the tax and his own funds to improve his family farm.

At one time, Missouri had the highest rate of erosion in the nation. That ranking led to the creation of the Missouri Soil and Water Conservation Districts in 1943. But it was not a quick fix. By 1983, Missouri was still losing soil at a rate of 10.8 tons per acre each year on cultivated cropland, according to the Missouri Citizens Committee for Soil, Water and State Parks.

That year, Missouri' General Assembly passed legislation that allowed citizens to vote on a constitutional amendment for a one-tenth-cent sales tax for state parks and soil conservation. In August 1984, voters approved the measure.

Since 1984, it’s estimated that programs supported by sales tax dollars have helped Missouri landowners keep more than 177 million tons of soil out of the state’s lakes, rivers and streams.

“The volume of soil that we have saved since 1984 is just phenomenal,” says Gary Vandiver, a farmer from Richmond and chair of the Missouri Soil and Water Districts Commission. “We’re not only protecting the soil and the cropland, we’re protecting the streams and the rivers from continued degradation that’s seen in a lot of other states that don’t have a tax like ours.”

Erosion rates have been cut in half since the initial passage of the sales tax, and since it was renewed in 2006, more than 61,000 conservation practices have been implemented through $348 million in cost-share grant projects.

~~~PAGE_BREAK_HERE~~~

Same tax, new vote

Estil Fretwell was part of the 1983 state legislature that voted to put the Parks, Soils and Water Tax on the voter ballot. He left the legislature in 1986 to work for Missouri Farm Bureau and today is the organization's Public Affairs Director.

"I don't know of any other effort in Missouri, quite like the Parks, Soils and Water Tax that has such a diverse coalition of support," he says. Fretwell noted that groups and individuals from agriculture, environment, conservation and parks have been behind the measure since its inception. "After all, when Farm Burearu and the Sierra Club are at the same table working together," he notes," we must be doing something right."

The Missouri Citizens Committee for Soil, Water and State Parks, is a group of more than 20 organizations and individuals advocating for the renewal of the one-tenth-cent parks, soils and water sales tax on the state ballot in Nov. 8.

The measure helps not only agriculture through soil and water conservation measures, but also rural Missouri communities.

Missouri Rural Electric Cooperative executive vice president Barry Hart says his association supports the tax because what it does for the rural economy. "People come and visit the parks and spend money in rural communities," he notes. "We can't afford to let our rural communities down."

In all, there are 88 state parks and historic sites in Missouri. Last year, more than 19.2 million people visited state parks and historic sites generating more than $1.02 billion.

Fretwell says the Parks, Soils and Water Tax is "good for Missouri." Hurst says it is needed for the future of farming.

The conservation cost-share programs offered because of the tax paves the way for farmers to improve the land. "When I leave my career as a famer," Hurst says," I know I will have left things better than they were when I started. That is all any of us ask for."

About the Author(s)

You May Also Like