January 27, 2020

Hemp became a hot topic in 2019, when the 2018 Farm Bill opened the market by changing the crop’s status from forbidden to legal. Many farmers got on the bandwagon. But in 2020, after the peak of that first cannabidiol (CBD) rush, Western hemp growers are in search of sustainable markets. Meanwhile, they must learn the idiosyncrasies of the crop.

Yet the many uses for hemp provide a wide range of market opportunities, which is a blessing and a curse. Many opportunities require producers to develop a market strategy to hit a profit.

New market challenges

The high prices commanded by CBD excited many farmers to jump into growing hemp with both feet. Many of these farmers in Washington state and Oregon struggled to harvest, dry and sell their hemp crop.

Across the Northwest, farmers planted more hemp acres than they could handle as they, and the market, learned the new crop. CBD extraction and drying facilities were too small to handle the current amount of hemp grown. Farmers also struggled to locate harvest machinery. Many were forced to swallow their monetary losses and leave hemp crops to decompose in the field.

“In 2018, Washington state had one hemp grower,” says Bonny Jo Peterson, Washington State Industrial Hemp Association executive director. “In 2019, we had over 100 growers. There were issues with obtaining the correct genetics, drip tape and plastic. We were, like most of the country, looking for equipment to plant.”

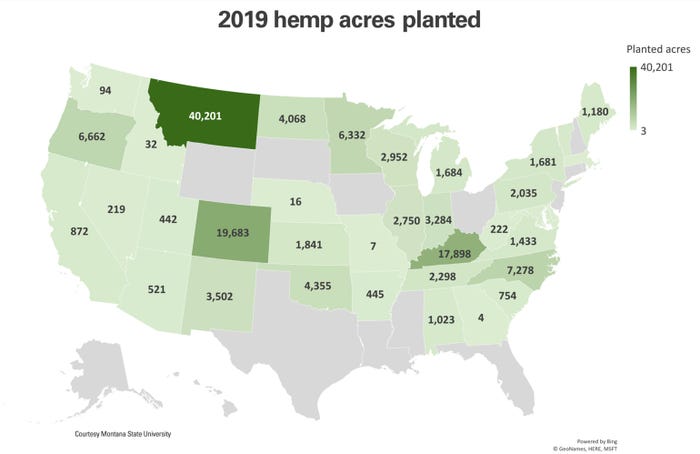

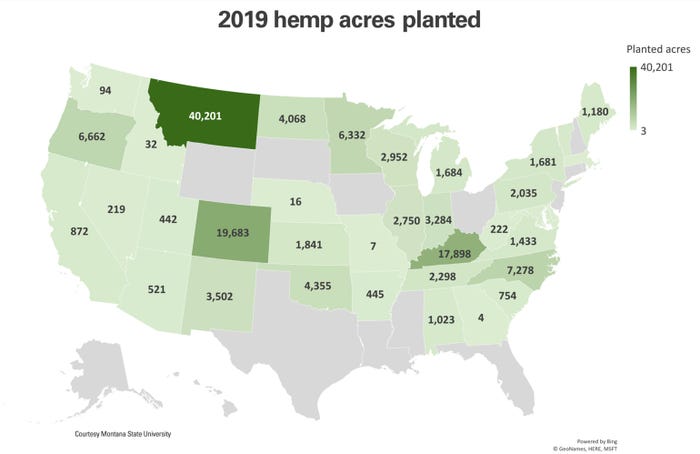

The rapid growth in hemp cultivation outpaced market capacity — and knowledge. According to Vote Hemp, a Washington, D.C.-based advocacy group, the number of acres of hemp licensed across 34 states totaled 511,442 in 2019 — more than quadruple the number of acres licensed from the previous year. State licenses to cultivate hemp were issued to 16,877 farmers and researchers, a 476% increase over 2018.

Oregon leads this movement, because it was the first state to adopt commercial hemp production. In 2019, farmers registered more than 60,000 acres of hemp in Oregon. “A year ago, there were about 7,500 acres grown in Oregon by around 100 farmers, and some people made really good money,” says Gregg Gnecco, who coordinates operations and farm relations for Hemp Northwest. “There were stories of the $50,000 acre. Those stories were true for maybe 20 or more farms, but the pace of market is less than the production surge. Last year there were over 1,900 hemp growers in Oregon. Some are doing very well, but most either lost everything or are stuck at some point in getting to market.”

CROP REVIEW: Gregg Gnecco, co-founder of Hemp Northwest, inspects seed production on a dual-purpose grain-fiber hemp crop in Washington. (Courtesy of Hemp Northwest)

Labor-intensive crop

Many farmers found hemp more labor-intensive than expected. Because of the lack of equipment, several farmers were left to plant hemp plugs by hand. Wildlife, especially elk, severely damaged hemp crops, which required extensive fencing to halt. Poorly timed harvest resulted in hemp molding in the field, or in inadequately ventilated drying racks and sheds.

“Nobody has made any money yet,” Peterson says of Washington state growers. “Some actually got something to market, met a contract or made their own product, but they didn’t realize any profit either. We’re considering success as, you grew this plant, got it out of the field, and dried it.”

Gnecco foresees the developing hemp market to continue to favor farmers and processors with capital that took an early risk three years ago, to begin growing hemp and processing for extracts.

“The FDA standards for food- or pharmaceutical-grade hemp processing separate the market,” Gnecco says. “Any brand that has anything behind it that they could lose, will buy from a known source — whether a grower or processor. Unfortunately, it’s allowed the early movers to establish themselves, their processes and reputation, and made it more difficult for smaller new operations entering the market.”

Despite these challenges, hemp is a multiuse crop, and its market opportunities bear watching.

Emerging opportunities

CBD products aren’t the only use for hemp. Its uses are categorized by the USDA Agriculture Marketing Service as oil, grain, seed and processed. CBD is categorized with other processed hemp products such as rope, textiles, paper, insulation, bioplastics and biofuel.

“The hemp market will evolve,” Peterson says. “I see the biofuel and the nanotechnology being five to 10 years out in Washington state. Biofuel processing will probably be about eight years. Besides people building extraction facilities, folks want to coordinate fiber for building materials and multiple plastic possibilities. The Tacoma shipping port is one of three ports on the West Coast that accommodates large ships, and there is strong support for hemp exports. With our rail lines to the port, we’re able to minimize the footprint of hemp export more than other parts of the country.”

CHECKING THE CROP: Tonia Farman, founder, Queen of Hearts Hemp Foods, examines maturing hemp seeds in an organic grain hemp field near Sequim, Wash. (Courtesy of Hemp Northwest)

While successful CBD hemp sales raise profits astronomically, the market steadily builds for hemp grain, seed and oil. Northwest Hemp owns its Hood River, Ore., processing facility; markets its own Queen of Hearts Hemp food brand; and counts an equine nutrition company among its hemp-oil clients. In Fort Benton, Mont., the IndHemp company is opening the largest U.S. hemp grain processing facility in February. Oilseed facilities continue to expand to process hempseed, such as Healthy Oilseeds LLC in Carrington, N.D. Market opportunities remain, but hemp growers must strategize.

“The U.S. hemp grain market is small right now,” Gnecco says. “Growing hemp for grain takes more acreage and returns smaller margins, but it is an opportunity for another rotation cash crop for farmers. There are things to learn with it. Hempseed is a raw food from field to shelf. There is no ‘kill’ step in processing. It requires careful handling, and new agricultural practices for grain farmers who are used to standing in their grain or touching it with bare hands. They have to treat hemp seed like a strawberry, even if they harvest it like a grain.”

COVERING THE COUNTRY: More states are seeing farmers plant hemp, and this is just going to grow.

Marketing steps suggested

Peterson and Gnecco recommend farmers embark on growing hemp with prudence. “Plan to lose every cent that you put into it as a new crop,” Peterson advises. “The farmers that gained experience this year, if you weren’t working with somebody else already, make sure you partner with another grower to learn from each other, and share equipment. Before you even buy seeds, set up your harvest and drying plan. If you plan to extract, contract your extraction time and put down your deposit. Here in Washington, the main CBD extractors are already booked up through October 2020.”

Growers interested in hemp should plant only a few acres as part of their diversified crop management plan, and seek to share equipment and knowledge with other hemp farmers. Before planting hemp, obtain a contract appropriate to the market outlets in your area to ensure sale of the crop. While the CBD processing and market capacity is currently full, the market for hemp grain, seed and fiber steadily broadens.

Hemken writes from Lander, Wyo.

About the Author(s)

You May Also Like